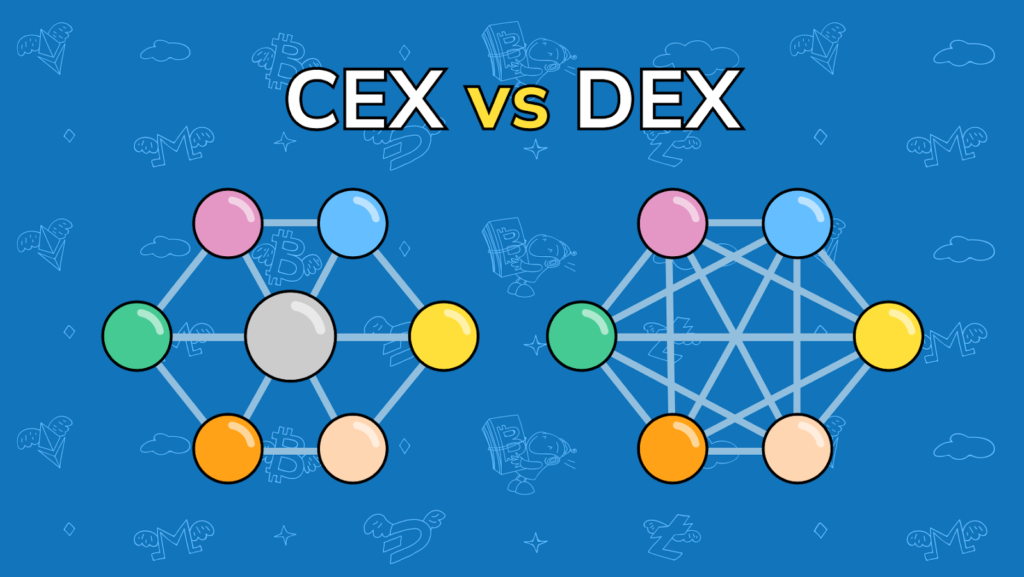

There are mainly two types of exchanges in cryptocurrency trading: centralized and decentralized exchanges. Both have their own additional pros and cons. In this article, we will dive into the pros and cons of both so you can choose the best one to suit your trading needs.

What Are Centralized Exchanges?

Centralized exchanges are those where some central authority manages the trading process. Well-known examples include Binance and Coinbase. In effect, these platforms act like a bridge between buyers and sellers.

Pros of Centralized Exchanges

-

User-Friendly Experience

Centralized exchanges provide a user-friendly interface. Most often, they have easy-to-use dashboards and tools. This simplicity may prove to be very useful to beginners.

-

High Liquidity

Liquidity defines how easily one can sell or buy an asset. Most of the time, centralized exchanges have high liquidity. That means you will be able to enact trades quickly without influencing the market price too much.

-

Customer Support

Most centralized cryptocurrency exchanges offer customer support services. In case of problems or other issues, you can reach out for help from their support teams. This could be vital in case you are a new trader.

Cons of Centralized Exchanges

-

Security Risks

Centralized exchanges keep your money in their custody. Their lucrative nature, therefore, makes them an enticement to hackers. If a breach happens, it is possible that your assets may be compromised.

-

Lack of privacy

By using most centralized exchange services, you will typically give away personal information. Sometimes, this includes proof of identity documents. If privacy is important to you, this may be a flaw.

-

Control over funds

In centralized exchanges, the exchange holds control over your funds. You are required to trust that they will handle your assets safely. This centralization can lead to possible problems in the event that such an exchange encounters operational issues.

What Are Decentralized Exchanges?

Decentralized Exchanges (DEXs) vs. Centralized Exchanges

Decentralized exchanges operate without any central authority. Such DEXs include Uniswap and SushiSwap. They make use of blockchain technology in peer-to-peer trading.

Pros of Decentralized Exchanges

-

Improved Security

DEXes are more secure. Your money is kept in your wallet, not on the exchange. This reduces the risk of losing assets due to a hack on the exchange itself.

-

More Privacy

Decentralized exchanges do not usually require personal information. You can therefore trade anonymously, if you really value privacy.

-

Control of Funds

With DEX, you are always in charge of your money. Since you trade from your wallet, you’ll have full ownership of your assets.

Cons of Decentralized Exchanges

-

Lower Liquidity

Since DEXs work independently with fewer users, they sometimes record lower liquidity when compared to centralized exchanges. Thus, it may be hard to execute large trades without significantly affecting the market price.

-

User Experience

The user experience with DEXs can also be less intuitive. They seem to require more knowledge about blockchain technology and trading practices. For beginners, this can be a difficult barrier to surmount.

-

Less customer support

Most decentralized exchanges offer very little in terms of customer support. In the case of problems, there may not be anyone to help as easily as in centralized exchanges.

While choosing between decentralized and centralized exchanges, consider what is more important to you. If you value usability, high liquidity, and customer support, then probably the best way to go will be centralized crypto exchanges. On the other hand, if what really matters for you is safety, privacy, and being the full owner of your funds, then decentralized exchanges would be more fitting.

Conclusion

While choosing between decentralized and centralized exchanges, consider what is more important to you. If you value usability, high liquidity, and customer support, then probably the best way to go will be centralized crypto exchanges. On the other hand, if what really matters for you is safety, privacy, and being the full owner of your funds, then decentralized exchanges would be more fitting