Cryptocurrency futures trading is changing the financial scene, as a unique way of dealing with digital assets. This allows investors to expect profits from the growth in value of cryptocurrencies like Bitcoin and Ethereum. They do not actually own these investment instruments; rather, to maintain their own trading activities it is necessary for them to deposit money with the exchange to secure and cover any possible profit or loss. There is one exception for such account holders: The company’s profit margin. Additionally, the company spends a considerable amount of time energy management and risk control.

Although the huge potential returns make futures trading look attractive, it is complex. Anyone who wants to try cryptocurrency futures trading will need a comprehensive understanding of how it works and what risks it involves.uci.is adds a lot more data on his blog or site for more information regarding futures trading. That way you can get some market perspective-or even market analysis-from someone who’s already succeeded in trading futures.

What Is Cryptocurrency Futures Trading

Investigating the whole market’s price increases of cryptocurrency futures trading in 1998 and later years, we see that Bitcoin rises went up 50-100%. The golden period for real operators lessened to a mere two months when monthly gold price changes ranged from $10-$20 dollars. But that was because those who traded futures contracts also played handrejected to be doing well by some clever observations on market action.

If you are trading futures for the first time, you’ll likely be amazed at how leveraged the trading of futures can be. The reason that leverage is so important in futures trading is because normal activities such as borrowing money to buy stocks or other assets are simply out of the way futures work. When trading futures, it will usually cost you next to nothing but a few dollars for each contract. In effect, $1 in margin capital could potentially control 400 contracts!

Using a futures contract for bitcoin is like betting that its price will increase. Buy a futures contract now at the current price, and when bitcoins increase in value you sell at a higher price–for profit! Conversely, if you expect future prices to fall, rather than taking short positions directly on bitcoin inept, instead sell out of long positions when they are near their peak levels and then wait until price declines before buying back in.

Prices on the stock market and interest rates should change as well when regulations are altered or modified. Imagine you decided to buy a lot of long-term tangible assets such as homes or cars from a bank while floating rates continue climbing once again: all those things will come at increasingly higher prices. Likewise, the interest that banks pay out on deposit certificates and saving accounts (though comically low) needs to keep up with inflation or people will swap into some other form of current income like dividends instead.

Benefits of Cryptocurrency Futures Trading

Levers Are One With Leverage

A possible attraction for folks interested in cryptocurrency futures trading is leverage. It means that traders can use a smaller amount of money to control a larger portion of the market, ultimately leading to higher potential returns. Think about it in numbers: A very small change in the virtual currency’s price could result in outsized profits. Such potential for a big return on your investment gives hope to those people who want to make as much as they can out of their funds.

Hedging and Risk Management

Futures contracts can be used to hedge risk, a particularly juicy bit of news for the holders of large amounts of crypto. Say you own Bitcoin and you’re dreading a potential price slump. By using futures contracts instead of buying the cryptocurrency directly, you can protect against such happenings. Taking a short position in Bitcoin futures serves to offset your potential losses in holding bitcoins. an example: The strategy enables you to keep your investment safely aboard and lock up current profits annually.

Liquidity and Market Access

Cryptocurrency futures markets are often highly liquid, a circumstance that lets you make trades quickly in and out without heavily impacting market prices. High liquidity guarantees efficient trade execution; you can place orders promptly. With futures trading, traders are able to profit on money that might not be available for direct trading. This expanded access allows traders to diversify their portfolios and seek different forms of profit within the cryptocurrency market.

Different Trading Styles

Different trading strategies can be employed based on market conditions and investment goals. For example, purchases may be made when prospects seem optimistic or short sales if one anticipates that things will get worse. Moreover, due to its trade-off characteristics with other financial instruments (for instance, options or spot transactions), the trading strategies can be made more complicated.

The risks of trading cryptocurrency futures

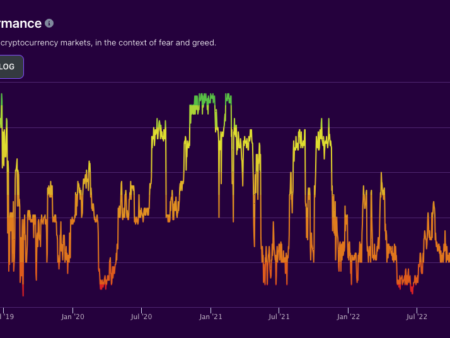

High Volatility

Cryptocurrencies are famous for their price volatility. A cryptocurrency can change in value over the course of a week by 50–200%. Such volatility gives rise to profitable opportunities and also risks of large losses. When futures trading is leveraged, this risk is magnified. A small adverse price movement can cause large losses.

Hence traders must be careful in risk management and use stop-loss orders to limit injuries. A shrewd policy can help obviate some risks from high volatility.

Complexity and Learning Curves

Futures trading can be complex and is particularly challenging for novices. A comprehensive knowledge of the principles that underlie trade is needed for understanding how futures contracts operate, meeting financial requirements at different stages in time, and avoiding potential penalties even though you complete only part of your order. Slowly grasping this complex material will take months or perhaps years. Inexperienced traders may become swamped by its intricacies if they do not have extra practice prior to undertaking full-scale futures operations. Understanding futures contracts, leverage, and risk management is essential before you start trading real money.

Market Risk and Volatility

The cryptocurrency market is volatile and frequently affected by various factors, such as news events, changes in regulations, or the market atmosphere. Before you know it, this information is gone: sudden and large movements in prices, which can greatly affect your futures positions. Traders should always keep an eye on the latest market developments and be prepared to adjust their strategies. They should read the news and do some analysis now and then, which will help them make more informed trading decisions.

Counterparty Risk

When you enter into a futures trade, you become a counterparty. This means that in the event of a default by your counterparty—be it another trader or entity—there is considerable loss waiting for you. Any reputable futures exchange has measures in place to control counterparty risk, but choosing a proper and well-regulated exchange may help reduce this risk to an acceptable level.

Getting Started with Cryptocurrency Futures Trading

To get started trading in cryptocurrency futures, follow these steps.

Choose a Reputable Futures Exchange: Look for an exchange that offers cryptocurrency futures trading that has rock-solid security and a reliable reputation. Look for high liquidity, user-friendly interfaces, and strong risk-management tools.

Open and Fund Your Account Set up an account with the chosen exchange and get through any necessary verification procedures. Then deposit funds in your trading account in order to act as a margin for futures contracts.

Understand the Basics: Learn how futures contracts work, including margin requirements, contract sizes, and expiration dates. Many exchanges provide educational materials and online demo accounts to help you get started.

Develop a trading strategy. Create a trading plan that outlines your aims, risk tolerance, and strategies. Decide how much leverage to use and establish stop-loss orders for managing your risk in a well-disciplined manner.

Start trading: Start with a small position in the hope of making money and also so you can acquire experience and build self-confidence. Interact closely with the market and, over time, develop your skills. Based on your trading performance and the specific conditions in any given market, adjust strategy as needed.

Conclusion

Cryptocurrency futures trading in one way or another offers high risk, with a dose of volatility and complexity that is quite challenging. By learning how cryptocurrency futures trading works and its potential gains and losses can be evaluated honestly and accurately, you’ll be ready to make informed decisions that are more geared towards their own benefit than those who simply follow the crowd. With careful planning and control of risk, cryptocurrency futures trading can be a powerful option for achieving your trading objectives.