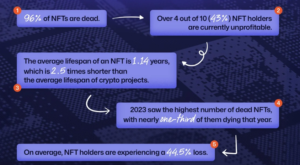

A startling 96% of non-fungible tokens (NFTs) are currently regarded as “dead,” throwing the once-booming NFT market into an unparalleled crisis.

According to an NFT Evening report, this digital extinction event coincides with substantial financial losses for over half of NFT holders, raising serious concerns about the future of digital ownership and blockchain-based assets.

According to a recent analysis by nftevening.com, 96% of non-fungible tokens (NFTs) are now regarded as “dead,” which is troubling news for the NFT market. The study draws attention to the high prevalence of unprofitability among holders and the short lifespan of the majority of NFTs.

NFT Sector Faces Uncertainty as Bull Run Through 2024 Ignores It

The once-celebrated future of digital ownership, the NFT market, is facing major obstacles today, as noted in nftevening.com’s 2024 forecast. The analysis evaluated more than 5 million transactions and 5,000 NFT collections to determine the current status of the market.

The study concluded that the great majority of NFTs no longer exhibit indicators of market viability. It evaluated NFTs based on trading volume, recent sales, and social media engagement.

The report’s financial data presents an unfavorable image for NFT investors. Currently, more than 43% of NFT holders are losing money on their investments; on average, a holder’s losses are 44.5%. An investigation has also been conducted into the lifetime of NFTs.

Compared to previous bitcoin projects, the average NFT currently lasts just 1.14 years, a 2.5-fold shorter duration.

This short lifespan illustrates how many NFT ventures have a high turnover rate and maybe little long-term value.

96% of NFTs were declared “dead,” which meant they had no trading volume, very little sales over 7 days, and were almost nonexistent on social networking sites like X. This disturbing discovery highlights the erratic nature of the market and the precarious position of many NFT enterprises.

96% of NFTs were declared “dead” in the 2024 report due to market instability.

The analysis highlights the financial burden that NFT investors are under, with almost 43% of holdings seeing negative returns. These investors have seen an average 44.5% decline in their assets. Remarkably, compared to standard crypto asset initiatives, the average longevity of an NFT today is just 1.14 years.

This briefness highlights the inability of NFTs to hold onto long-term value, which adds to the general volatility of the market. According to Bitcoin.com News, NFT sales decreased 41.36% in July over June, with digital collectible sales in July being 36.6% less than June’s.

Furthermore, the study conducted by nftevening.com reveals a significant disparity in the profitability of various NFT collections. Some collections—like the Azuki collection—have prospered because of their strong community involvement and astute marketing, while others—like the Pudgy Penguins collection—have collapsed, with holders seeing a 97% reduction in value.

We can’t be sure if NFTs are actually at their lowest point because their future is still unknown. Unfortunately, NFTs have trended in the other direction, declining steadily from the year’s beginning, while other sections of the cryptocurrency and blockchain ecosystem have grown during the 2024 bull run. However, NFT sales have stabilized at a total value of $66.128 billion in sales.

Conclusion

The NFT market is currently experiencing a collapse, with 96% of NFTs being classified as “dead” due to minimal sales, trading activity, and social media engagement. Over half of the holders are facing significant financial losses, averaging 44.5%. As the larger crypto market thrives in a 2024 bull run, NFTs have been left behind, showing a consistent decline throughout the year. Whether this marks a permanent downfall for the NFT market or the lowest point before a potential recovery remains uncertain.