As the cryptocurrency market prepares for October, which is also colloquially known as “Uptober” among the trading community, billionaire and co-founder of BitMEX Arthur Hayes is gaining viral fame for his savvy investment into meme coins and Solana (SOL). Hayes apparently has stockpiled some 24 billion PEPE tokens and reportedly has an interest in meme projects based on the Solana blockchain, such as MOTHER and MOG. This post digs deeper into Hayes’ investment strategy and the price action of Solana’s recent market state. Can Solana attain a price of $1,000 in the future?

Arthur Hayes’ Investment Strategy

Solana remains bearish below $156.50. Immediate support at $154.00; break lower could target $151.35 and $149.03. Resistance at $159.34, $161.50, and $163.79.

📉 RSI 48.17, weakening momentum. Price below 50-EMA. Watch $154.00 support for direction.

Arthur Hayes is gearing up for potentially rising markets by spreading his holding across the different blockchain networks. His massive scale of buying meme coins indicates that Hayes has been growing bolder in his views of meme coins’ shining during rising momentum in markets. According to data from SpotOnChain, Hayes had a habit of scooping community-driven tokens, reasoning they would be the initial beneficiaries in case of a market reversal.

Apart from PEPE, an Ethereum-based meme coin with huge community support, Hayes further diversified his portfolio by researching the emerging market of meme coins on Solana. Smoking Chicken Fish (SCF) and Ponke (PONKE) are just some of the notable tokens in his collection, pointing to his opinion that Solana is turning out to be a sweet spot for newer projects in meme coins, wherein traders are interested in dabbling into altcoin space.

Current Solana Market Status

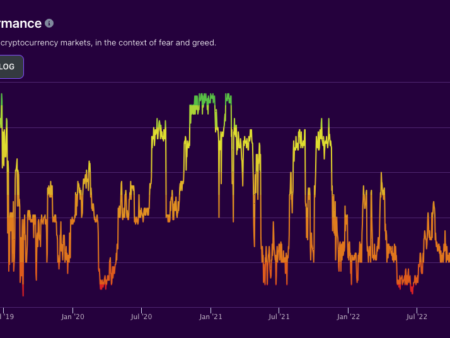

While news on meme coins created some buzz, Solana has had some bad days lately. So far on September 29, 2024, the SOL price has also lost support at the bottom of an ascending channel around $156.50. Immediately, this technical move is concerning for traders and investors since on-the-spot support at the level of $154.00 could break. More precipitous drops can happen later at levels of $151.35 or $149.03.

SOL/USD Price Action

Solana is trading below the crucial point at $156.50. The immediate support to be monitored is noted at $154.00. If broken, then it can expose it to a more severe correction.

Resistance Levels

If there is an attempt to bounce back by the SOL, then resistance levels that are to be kept in view are $159.34, $161.50, and $163.79.

Relative Strength Index (RSI): The RSI is at 48.17, which means the momentum has weakened. A close below the 40 mark will not only confirm some selling pressure but may also propel it further, as traders may get some sense of skepticism.

Moving Averages: The 50-day EMA at $156.48 acts as near resistance. That is, the trend is bearish until the price manages to take this back.

Key Take-Aways

Bearish Momentum: Below $156.50, SOL is trapped in bearish control.

Support and Resistance Levels: One needs to watch for a breakdown of the critical support at $154.00 for the downtrend or move above the support line at $156.50 to come back to bull territory again.

Historical Perspective: October and Market Trends

Historically, October has been a good month for cryptocurrencies, although marked by frequent big rallies and increased trading activity. Focusing on community-driven tokens and meme coins, it may be said that the general mood among traders is to expect the much-awaited peak of interest and investment within this period.

In addition to collecting meme coins, Hayes also asked his community for suggestions on how to improve his meme coin portfolio. Such community engagement highlights the significance of social sentiment in the market, at least when it comes to meme coins driven by community energy.

Do Solana Tokens Have the Potential to Go Up to $1,000?

Whether Solana would touch the ambitious sky-high targets of $1,000 is what everyone in the trading world wants to know. Though Solana has been phenomenal in terms of growth from day one, it would take all favorable market conditions, high adoption, and continued development within the Solana ecosystem to make such targets achievable.

Factors That Would Impact Solana’s Price Potential

Market Sentiment. Strong positive market sentiment alone can propel SOL to new heights, especially if Bitcoin and other top coins maintain their upward trends.

Adoption and use cases. Developers and projects mean everything for Solana, so when the demand for native tokens is driven by the number of developers and projects, that’s what would matter.

Meme Coin Rally: As Hayes and other investors collect their stash of meme coins, more attention could be paid to the general crypto market, which will benefit SOL as long as it stays on top, leading the pack of blockchains as a decentralized application hub.

Conclusion

We are coming to the last quarter of October, and Arthur Hayes’ strategic investments in meme coins and Solana do provide a glimpse into the evolving direction of cryptocurrency trading. Solana may be under bearish pressure at this point, but the historical trends of October combined with Hayes’ positive stance on meme coins might present traders with a rare opportunity.

Solana now has to navigate holding the immediate attention of holding above the critical support while trying to break above resistance. Again, whether Solana hits $1,000 remains to be seen, but it certainly could be if the market conditions continue to prop it up and evolve.

This will be interesting, as this price action in the coming weeks should finally reveal the most important insights into the future trajectory for Solana and its place in the broader cryptocurrency market.