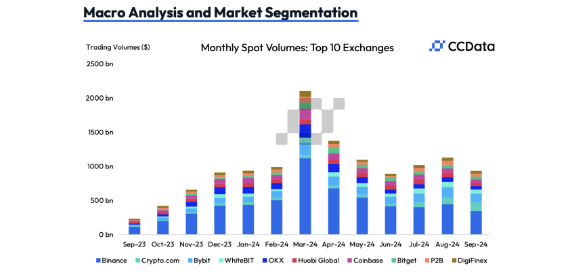

Binance share Decline- Trading volumes on centralized exchanges (CEXs) experienced a sharp decline in the cryptocurrency market in September 2024. Trading activity in both the spot and derivatives markets reduced, while their combined volumes declined by 17%. According to CCData, the total volume of the two markets stood at $4.34 trillion, the lowest such trading activity since June 2024.

Spot trading volumes were down by 17.2% to $1.27 trillion, which is the lowest since June. The decrease in derivatives markets also stood at 16.9%, as spot volume fell to $3.07 trillion. Seasonal decline, uncertainty over macroeconomic views, and the cautious stands of traders waiting for clearer signals in the markets have all been thrown around for reasons behind the recent drop in trading activity.

Seasonality and Crypto Markets

The decrease during September was largely due to the end of the summer season, which had characterized the less than impressive participation in the markets. Traditionally, the volumes have been seen to decline with the coming of summer since the investors generally move out of the markets.

Historical patterns show that the fourth quarter is always the most active quarter in cryptocurrency trading. The fourth quarter saw the most quarterly trade volume over the last ten years on six different occasions. Many market analysts believe that this trend may continue into 2024, hoping that catalysts such as improved market liquidity and a possible U.S. Federal Reserve interest rate cut will fuel the process and, of course, the U.S. presidential election.

Binance Loses Ground as Market Share Plunges Sharply

Binance, the largest centralized exchange by volume, had one of its steepest losses last month in September. The currency trading platform’s spot volume declined by 22.9%, while its market volume reached a record $344 billion. That marks the lowest monthly spot trading volume for Binance since November 2023. Binance’s spot market share plunged to 27% that month—the first time below 30% since January 2021.

The derivatives market also was not spared from the experience. Trading volume on Binance declined by 21% to $1.25 trillion. The level was the smallest that the exchange has recorded since October 2023. Binance’s total market share in derivatives trading fell to 40.7%, the lowest since September 2020.

Binance total market share combined by including both spot and derivatives trading stood at 36.6%. Still way far from the peak that such an exchange like Binance had during earlier years, when it dominated a huge part of the market.

Why Is Binance’s Market Share on Decline?

A number of things can decline the market share of Binance. The very first key reason is related to increased regulatory scrutiny and challenges in multiple jurisdictions. For the past years, Binance has been experiencing regulatory pressure from the United States, the United Kingdom, and Japan, and it limits their ability to offer services within those regions.

Competition has incrementally chipped away at Binance’s stranglehold, as competing exchanges have introduced better fees, innovative products, and user experience. Centralized and decentralized exchanges, or DEXs, have increasingly been becoming more fragmented in the market, with activity spreading across platforms instead of relying on one big player.

Most importantly, macroeconomic uncertainty due to rising interest rates, inflation, and global economic slowdowns could affect the overall crypto market. Naturally, many of the traders and investors have adopted a more cautious attitude owing to these developments, thereby reducing the overall trading volumes across the board, including Binance.

Crypto.com Rises Amid Decline

As Binance struggled, others like Crypto.com took advantage of the dynamics in the market and expanded their share. Crypto.com was impressive on both spot and derivatives trading during the month of September. The spot trading volume on the platform grew by 40.2%, while derivatives surged with records to all-time highs worth $134 billion and $149 billion, respectively.

Combined spot and derivative trading market share on Crypto.com reached 11% and brought the centralized exchange to the fourth position by trading volumes in September. This growth emphasizes how exchanges, which happen to provide competitive features, user-friendly interfaces, and good trading conditions, can flourish even when market volumes decline everywhere else.

Open Interest and the Federal Reserve

At the overall trading volume decline, open interest in cryptocurrency futures and options jumped 32.1% to $52.4 billion in September. Open interest is essentially the sum of outstanding derivative contracts that are still unsettled. This rise in open interest signals that the traders have slightly optimistic views. For example, after the U.S. Federal Reserve cut interest rates by 50 basis points in September, optimism was seen.

Easy borrowing and potentially better liquidity resulting from the Federal Reserve rate cut mean that investors are breathing easier. Attention towards cryptocurrency derivatives returned as traders sought better ways to speculate and hedge in a more liquid environment.

An open interest source, which tracks the amount of contracts outstanding at any given time, also witnessed a rise in this above surge, carrying it to an increase in the average funding rate for Bitcoin futures contracts. This increased funding rate rose from 0.70% to 1.21%. Funding rates represent the payments made between traders on the futures platforms in order to rebalance their demand for long and short positions. This higher funding rate means that, overall, there is a better expectation about the near-term price of Bitcoin from a trader’s point of view.

Looking Ahead: What’s Next for the Crypto Market?

Raise on concerns and worry several raises after several successive trading volumes in September months, though still with a hope that the market would bounce back within the coming months. Historically, the fourth quarter is considered to be the strongest period for cryptocurrency trading. Many analysts believe that 2024 will follow the trend.

There could be several reasons why trading volumes could take off. The U.S. Federal Reserve continues to cut interest rates, and this move is presumed to inflate liquidity, thereby more readily letting traders into the markets. Secondly, trading volumes may rebound ahead of the U.S. presidential election scheduled for November, given that political events nearly always send financial markets into overdrive.

In addition, the crypto market will suddenly spike with rapid bursts of activity, particularly when major news is brought about, or when major technological advancements are also underway. In fact, approval for a Bitcoin ETF or launching a new blockchain protocol can make the market hot again, and this increases trading volumes through centralized exchanges.

Conclusion

September 2024 was a pretty testing month for centralized exchanges, with trading volumes plummeting by another stupendous 17 percent. Binance, the erstwhile crypto undisputed leader, suffered an across-the-board decline in both spot and derivatives trading and saw its market share stand at its lowest in years. Increased competition and an intensifying surge in regulatory challenges are likely to see its market position further eroded.

However, there are bases for optimism at this stage. Open interest has skyrocketed as there’s renewed interest in crypto derivatives, and the fourth quarter is generally strong in trading activities. The market looks into the future with catalysts like the U.S. Even Federal Reserve rate cuts and the U.S. presidential election may help trading volumes grow in the final months of the year.