IMF Urges El Salvador to Strengthen Bitcoin Risk Management

The International Monetary Fund (IMF) has called on El Salvador to reassess its Bitcoin policies and improve its cryptocurrency regulations. IMF Advises El During a press conference on October 3, Julie Kozack, the director of the IMF’s communications department, emphasized the collaborative efforts between IMF staff and Salvadoran officials.

Their objective is to finalize a new IMF-supported program aimed at stabilizing the nation’s economy, implementing necessary adjustments, and promoting reforms focused on growth. Conversely, failing to heed these recommendations could hinder the country’s economic recovery and create uncertainty in the cryptocurrency market.

Ultimately, El Salvador’s response to the IMF’s advice will be pivotal in shaping its financial stability and may influence the future of cryptocurrency regulations throughout the region.

IMF Recommends Enhancing Bitcoin Risk Management

IMF 1

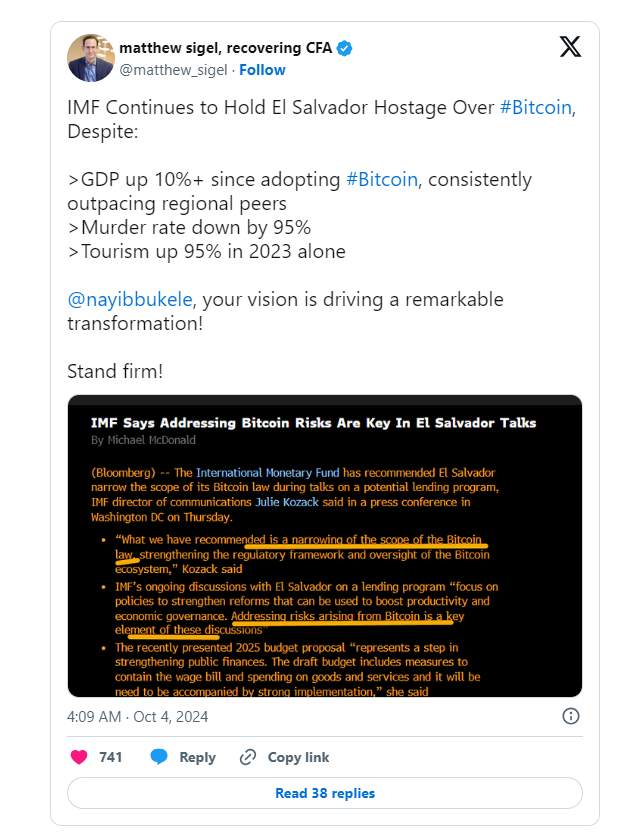

The IMF underscores the importance of improved risk management regarding Bitcoin in its ongoing discussions with El Salvador. Julie Kozack outlined several recommendations from the IMF, including narrowing the scope of El Salvador’s Bitcoin law, enhancing regulatory oversight, and reducing the government’s exposure to Bitcoin.

These recommendations reflect ongoing concerns about the risks associated with Bitcoin being used as legal tender. Should the country follow this advice, it could foster a more stable economic environment, attracting foreign investment and promoting sustainable growth. These measures are designed to mitigate the potential risks tied to Bitcoin as legal tender. By implementing these steps, El Salvador can work towards establishing a more secure economic framework while ensuring its cryptocurrency approach is responsible and sustainable.

Kozack also noted that El Salvador’s budget proposal for 2025 represents a positive step toward improving public finances. If executed effectively, these changes could contribute to a more stable financial landscape, encouraging investment and supporting economic development.

IMF Voices Ongoing Concerns Over El Salvador’s Bitcoin Adoption

It is important to remember that the International Monetary Fund (IMF) has expressed concerns about El Salvador’s decision to adopt Bitcoin as legal tender.

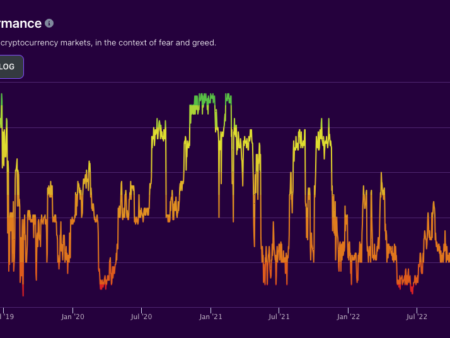

Following this move in September 2021, the IMF cautioned that Bitcoin’s volatility could lead to financial instability and pointed out the lack of consumer protections in cryptocurrency transactions. They also indicated that such innovations might complicate future financial assistance from the IMF.

As of August 2024, while major risks had not yet materialized, the IMF continued to stress the need for enhanced transparency and risk management related to Bitcoin. The agency acknowledged that further efforts are required to address potential fiscal and financial stability issues stemming from the Bitcoin initiative.

Ignoring these warnings could result in persistent economic challenges and diminish El Salvador’s prospects of securing future international financial support.

If the nation successfully aligns with the IMF’s recommendations, it could set a global precedent for integrating cryptocurrencies into national economies while maintaining financial stability.

IMF Urges El Salvador to Strengthen Bitcoin Risk Management

The International Monetary Fund (IMF) has called on El Salvador to reassess its Bitcoin policies and improve its cryptocurrency regulations. During a press conference on October 3, Julie Kozack, the director of the IMF Advises , emphasized the collaborative efforts between IMF staff and Salvadoran officials.

Their objective is to finalize a new IMF-supported program aimed at stabilizing the nation’s economy, implementing necessary adjustments, and promoting reforms focused on growth. Conversely, failing to heed these recommendations could hinder the country’s economic recovery and create uncertainty in the cryptocurrency market.

Ultimately, El Salvador’s response to the IMF’s advice will be pivotal in shaping its financial stability and may influence the future of cryptocurrency regulations throughout the region.

IMF Recommends Enhancing Bitcoin Risk Management

The IMF Advises underscores the importance of improved risk management regarding Bitcoin in its ongoing discussions with El Salvador. Julie Kozack outlined several recommendations from the IMF, including narrowing the scope of El Salvador’s Bitcoin law, enhancing regulatory oversight, and reducing the government’s exposure to Bitcoin.

These recommendations reflect ongoing concerns about the risks associated with Bitcoin being used as legal tender. Should the country follow this advice, it could foster a more stable economic environment, attracting foreign investment and promoting sustainable growth. These measures are designed to mitigate the potential risks tied to Bitcoin as legal tender. By implementing these steps, El Salvador can work towards establishing a more secure economic framework while ensuring its cryptocurrency approach is responsible and sustainable.

Kozack also noted that El Salvador’s budget proposal for 2025 represents a positive step toward improving public finances. If executed effectively, these changes could contribute to a more stable financial landscape, encouraging investment and supporting economic development.

IMF Voices Ongoing Concerns Over El Salvador’s Bitcoin Adoption

It is important to remember that the International Monetary Fund (IMF) has expressed concerns about El Salvador’s decision to adopt Bitcoin as legal tender.

Following this move in September 2021, the IMF cautioned that Bitcoin’s volatility could lead to financial instability and pointed out the lack of consumer protections in cryptocurrency transactions. They also indicated that such innovations might complicate future financial assistance from the IMF.

As of August 2024, while major risks had not yet materialized, the IMF continued to stress the need for enhanced transparency and risk management related to Bitcoin. The agency acknowledged that further efforts are required to address potential fiscal and financial stability issues stemming from the Bitcoin initiative.

Ignoring these warnings could result in persistent economic challenges and diminish El Salvador’s prospects of securing future international financial support.

If the nation successfully aligns with the IMF Advises, it could set a global precedent for integrating cryptocurrencies into national economies while maintaining financial stability.

The Implications of Bitcoin as Legal Tender

El Salvador’s decision to adopt Bitcoin as legal tender has been a pioneering move that drew global attention. By embracing Bitcoin, the government aimed to promote financial inclusion and provide an alternative to its citizens who have limited access to traditional banking services. However, this decision has come with significant risks that the IMF AdvisesF has consistently highlighted.

The primary concern revolves around Bitcoin’s notorious price volatility. Unlike traditional fiat currencies, Bitcoin’s value can fluctuate dramatically in short periods, leading to uncertainty for both consumers and businesses. For instance, a sudden drop in Bitcoin’s price could render contracts denominated in Bitcoin effectively worthless, impacting businesses and individuals who rely on this cryptocurrency for everyday transactions. Such scenarios create an environment where economic instability becomes a tangible threat, undermining the very goals that the Bitcoin law was intended to achieve.

Additionally, the lack of regulatory frameworks surrounding cryptocurrency transactions raises questions about consumer protection. Many users may not fully understand the risks involved in dealing with cryptocurrencies, leading to potential losses and fraud. The IMF Advises has repeatedly urged El Salvador to implement robust consumer protection mechanisms to mitigate these risks. Without adequate safeguards, the government risks exposing its citizens to significant financial vulnerabilities.

The Role of Transparency and Education

Moreover, enhancing transparency in cryptocurrency transactions is crucial. A well-regulated environment fosters trust among users and investors. By adopting clear guidelines and regulatory measures, the Salvadoran government can create a more stable and secure cryptocurrency ecosystem. This, in turn, could help in attracting foreign investment, as potential investors are more likely to engage with markets that have strong regulatory oversight.

Education also plays a vital role in this landscape. Many Salvadorans may not be well-versed in the complexities of cryptocurrencies, which can lead to misunderstandings and poor financial decisions. Public education campaigns focused on digital literacy and cryptocurrency usage could empower citizens to make informed choices about their financial activities.

Potential Benefits of Aligning with IMF Recommendations

Should El Salvador heed the IMF’s recommendations, IMF Advises El the nation could not only improve its financial stability but also set an example for other countries considering similar paths. Countries that have been hesitant to adopt cryptocurrencies due to perceived risks may look to El Salvador’s experience as a case study, particularly if it demonstrates that a balanced approach can yield positive outcomes.

In summary, the IMF Advises is essential for El Salvador as it navigates the complexities of integrating Bitcoin into its economy. By enhancing risk management, improving regulatory oversight, and prioritizing consumer protections, El Salvador can work towards a more stable financial future. The outcome of this endeavor will likely influence not only the country’s economic landscape but also the broader discourse surrounding cryptocurrency regulations worldwide.