Since early August, Litecoin’s (LTC) price has remained consolidated within a tight range. Litecoin Although it briefly broke free from this range, it quickly fell back, suggesting a weakening bullish momentum.

This has left traders concerned about a potential extended period of stagnation. However, increased activity among LTC whales could signal a forthcoming shift in momentum, as these large holders appear ready to influence Litecoin price trajectory.

Surge in Whale Activity

The past month has seen a significant rise in whale activity surrounding, indicating heightened interest from major investors. Transactions exceeding $100,000 have surged by 38%, escalating from $3.21 billion to $4.43 billion. This increase in large-scale transactions is a positive development, as it suggests that whales are actively accumulating LTC, possibly gearing up for a bullish breakout.

Historically, whale accumulation has often been a precursor to notable price movements, given their capacity to sway market trends. If this pattern persists, it could reflect growing confidence in Litecoin’s potential to escape its consolidation phase.

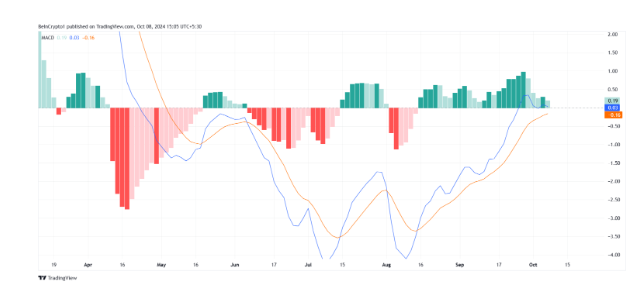

Despite the bullish sentiment associated with whale activity, technical indicators present a contrasting view. The Moving Average Convergence Divergence (MACD) indicator suggests that a bearish crossover may be on the horizon.

The MACD histogram’s green bars, which signify bullish momentum, are diminishing, indicating that selling pressure could soon rise. Should a bearish crossover materialize, it might overshadow the bullish signals emanating from whale activity, potentially leading to a price decline.

Litecoin

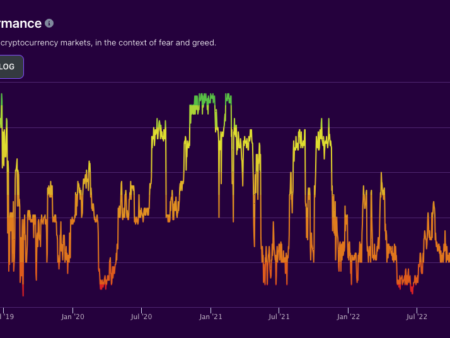

This divergence between whale transactions and the MACD implies that price may be entering a volatile phase. While whales could continue their accumulation, broader market indicators indicate that bearish forces are gathering strength.

Litecoin

LTC Price Forecast: Targeting an Upsurge Litecoin

Litecoin is currently trading at $65, fluctuating between a range of $68 and $59. If LTC manages to break through the upper boundary of this range, it could trigger an 18% rally, pushing the price up to $76. This would signify a substantial recovery for the cryptocurrency, propelled by whale activity and optimistic sentiment.

Litecoin

However, this potential price increase hinges on whales sustaining their buying momentum and outpacing broader market bearish trends. A confirmed breakout would necessitate Litecoin flipping $68 into support, signaling the onset of a new bullish phase.

On the other hand, if Litecoin fails to surpass $68 and remains below this critical level, the period of consolidation could persist, extending the stagnation phase. A drop below $59, coupled with waning whale activity, would invalidate the bullish outlook and could lead to further price declines.

Market Sentiment and External Factors

Market sentiment can significantly impact cryptocurrency prices, and Litecoin is no exception. The current climate is influenced by broader economic conditions, including interest rate changes and macroeconomic uncertainties. Traders are also keeping an eye on upcoming Federal Reserve meetings, which could provide further clues on market direction. Should the Fed signal a more hawkish stance, this could result in further pressure on cryptocurrencies, including Litecoin.

Conclusion

In summary, the recent surge in whale activity surrounding Litecoin presents a glimmer of hope for an impending price rally. The accumulation by large investors suggests that there is confidence in potential to break free from its current consolidation phase. However, the conflicting signals from technical indicators, particularly the MACD, indicate that caution is warranted. The broader market dynamics and external factors, including economic conditions and regulatory developments, will also play a critical role in shaping Litecoin trajectory.

As traders navigate this landscape, the key levels to watch are $68 and $59. A breakthrough above $68 could pave the way for an 18% rally, while a decline below $59 could trigger further bearish sentiment. Ultimately, staying informed and adaptable will be essential for investors as they monitor Litecoin’s price movements and the overall market sentiment. The coming days and weeks will be pivotal, and traders should prepare for potential volatility as the market responds to whale activities and broader economic influences.