South Korea has now enabled married couples to divide their cryptocurrency holdings during divorce proceedings.

According to IPG Legal, a law firm specializing in South Korean legal matters, the country’s laws now recognize both tangible and intangible assets, including cryptocurrencies, as part of marital property.

The firm referred to Article 839-2 of the Korean Civil Act, which allows either spouse to request a division of assets acquired during marriage upon divorce.

Virtual Assets Classified as Property

This provision applies to digital assets like cryptocurrencies, reinforcing a 2018 ruling by South Korea’s Supreme Court. The court’s decision classified virtual assets as property due to their economic value as intangible assets. Consequently, cryptocurrencies accumulated during marriage can be included in the division of the marital estate.

This means that a spouse can request a “fact-finding investigation” through the courts if they suspect their partner holds undisclosed crypto assets. The investigation aims to determine the value of these holdings, which could influence the division of assets during the divorce.

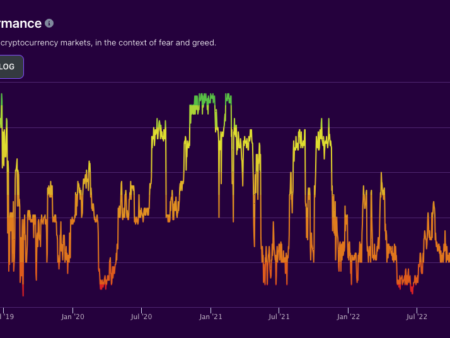

Tracking cryptocurrency during such proceedings can be easier than tracking traditional cash assets, thanks to blockchain technology. Blockchain records provide a transparent ledger of transactions, making it challenging for individuals to conceal crypto transactions or erase records. Additionally, bank withdrawal records and forensic analysis can assist in identifying hidden crypto investments.

Couples going through a divorce can choose to either liquidate the crypto holdings before dividing them or split the tokens directly, depending on their preference and the nature of the assets.

South Korea

The increasing integration of digital assets into financial dealings has led to a rise in divorce cases involving cryptocurrencies globally. For example, a recent case in New York saw a woman discover her husband’s concealed Bitcoin holdings during their divorce proceedings. She hired a forensic accountant who uncovered 12 BTC worth around $500,000 stored in an undisclosed wallet. This revelation underscored the challenges and surprises that digital assets can introduce into divorce settlements, emphasizing the need for legal clarity in such cases.

South Koreans Turn to Crypto

A recent survey indicated that many young South Korea ns are losing faith in the national pension system, with many viewing cryptocurrencies and stocks as better alternatives. The study found that over three-quarters of people aged 20-39 “don’t trust” state-issued pensions. More than half of respondents who claimed they were making their own pension plans indicated they were building their retirement funds using stocks and crypto.

Interestingly, about 7% of election candidates also have exposure to cryptocurrencies, according to a report by Yonhap that analyzed their asset disclosures.

Recently, it was reported that South Korea plans to implement stricter regulations for token listings on exchanges, including blocking tokens that have been hacked. The country’s financial authorities are preparing to release guidelines for virtual asset trading support, which are expected to be published by the end of this month or early next month.

Conclusion

In summary, South Korea’s recognition of cryptocurrency as a divisible asset in divorce proceedings marks a significant development in the legal landscape surrounding digital assets. By classifying cryptocurrencies as part of marital property, the country aligns itself with the evolving nature of financial transactions in the digital age. This legislative change not only empowers individuals to seek fair settlements but also underscores the importance of transparency and accountability in financial matters during divorce.

The ability for spouses to initiate fact-finding investigations into undisclosed crypto assets highlights the need for vigilance and due diligence in modern financial dealings. As blockchain technology provides a clear and immutable record of transactions, it has become increasingly difficult for individuals to conceal their cryptocurrency holdings. This technological advantage not only aids in the fair division of assets but also ensures that both parties can make informed decisions based on accurate valuations.

Moreover, the growing interest in cryptocurrencies among South Koreans, particularly younger generations, reflects a broader trend of shifting perceptions regarding traditional financial systems. With many expressing distrust in state pensions, an increasing number are turning to digital assets and stocks as viable alternatives for retirement planning. This shift emphasizes the necessity for legal frameworks to adapt to new financial realities, ensuring that individuals can navigate the complexities of asset management in a digital economy.

As South Korea continues to evolve its regulatory landscape, the implications for divorce proceedings involving cryptocurrencies could serve as a model for other nations grappling with similar issues. The introduction of stricter regulations and guidelines for virtual asset trading will further bolster the integrity of the crypto market, fostering an environment where digital assets are treated with the same respect and consideration as traditional financial instruments. Ultimately, the interplay between legal recognition, technological advancements, and changing societal attitudes will shape the future of cryptocurrency in both divorce and broader financial contexts.