Donald Trump’s prospects for the 2024 U.S. presidential election have experienced a significant surge on Polymarket, a popular prediction market platform. Currently, Trump’s chances of winning are listed at 60.1% in election, compared to Vice President Kamala Harris, who holds a 39.8% probability.

This notable gap marks a sharp change from earlier this month when the two candidates were nearly neck and neck in their odds. The sudden rise in Trump’s chances has sparked widespread attention and speculation, with many suggesting that the shift could be the result of a few large wagers from pro-Trump supporters influencing the market.

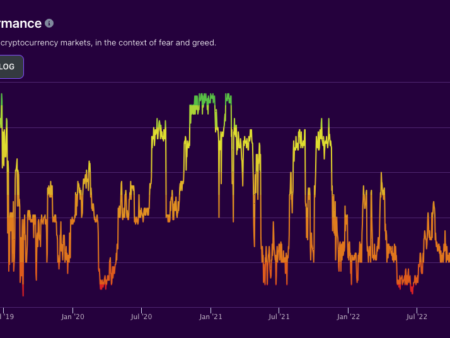

Some analysts believe that prediction markets, while useful, can sometimes be swayed by concentrated bets, especially when emotions run high in political events. Polymarket, which allows users to bet on the outcome of various real-world events, has seen fluctuations in the past, but the recent jump in Trump’s odds is raising questions about the market’s stability and how much influence individual players can have on public perception.

The broader political landscape remains unpredictable, and many will be watching closely to see whether these odds hold or fluctuate further as the 2024 race intensifies. Some critics argue that market manipulation could mislead public opinion, creating a distorted view of the candidates’ actual standing in the election. Regardless, this development adds another layer of intrigue to an already tense and competitive race.

Trump Token Launch resulted

Spike in Trump’s Election Odds Sparks Manipulation Concerns

Recent movements on Polymarket have triggered concerns that Donald Trump’s surge in odds may be the result of a few high-stakes bettors. Reports indicate that four users, going by the names Fredi9999, Theo4, PrincessCaro, and Michie, have collectively placed over $25 million in bets favoring Trump. These significant trades are believed to have substantially influenced the platform, pushing Trump’s odds of winning the 2024 U.S. presidential election sharply upward.

These accounts have allegedly been quite active over the past few weeks, with Fredi9999 emerging as particularly prominent. Political betting enthusiast Domer has noted that Fredi has been making sizable deposits from the cryptocurrency exchange Kraken and consistently betting on Trump across various markets. This persistent activity has not gone unnoticed by the community, leading some experts to suggest that the market might be experiencing a form of manipulation.

Polymarket, known for its real-time prediction markets, often reacts to significant trading volumes, and the recent spike in Trump’s odds has raised red flags about the potential influence of a few key players. some analysts are now questioning the integrity of such prediction platforms, warning that large-scale bets like these can distort market predictions and create a misleading perception of political outcomes.

The controversy has ignited debate about whether prediction markets should impose stricter controls to prevent individuals or groups from disproportionately affecting odds. This situation highlights the fine line between legitimate betting and market manipulation, which could undermine the credibility of platforms like Polymarket in forecasting major political events.

As the 2024 U.S. presidential race continues to heat up, more scrutiny will likely be placed on how these platforms operate and whether such trades are reflective of genuine voter sentiment or simply the financial power of a few backers. With political betting gaining popularity, these concerns may prompt calls for greater transparency and regulatory oversight.

Experts Raise Concerns Over Market Manipulation

The recent surge in large bets on Polymarket election has sparked controversy, with many questioning the platform’s integrity. Domer, a pseudonymous political bettor, pointed out that these pro-Trump accounts may be strategically depositing funds to manipulate the odds in favor of Donald Trump. According to Domer, these users appear to be working together, placing significant bets on Trump, which then dramatically increases his chances of winning. For instance, a single bet on Trump winning the popular vote raised his odds from 26% to 39% in just a few hours.

Nate Geraci, president of the ETF Store, also commented on the situation, suggesting that such large bets could be an attempt to create the illusion of growing momentum for Trump. Geraci referenced crypto investor Adam Cochran, who proposed that the surge in betting activity might be used to give Trump a narrative to claim election fraud if he loses. Cochran, a Republican voter who supports Kamala Harris, believes these manipulated odds could be leveraged to cast doubt on the election outcome in the event of a Trump defeat.

Bitcoin PAC Endorses Trump as Election Nears

The rise in Donald Trump’s election odds coincides with the launch of a campaign ad by the Bitcoin Voters PAC, a pro-Bitcoin political action committee, in support of Trump. The ad, currently airing in Pennsylvania, highlights Trump’s growing popularity within the cryptocurrency community. Recently, Trump raised around $7.5 million in crypto donations, including Bitcoin (BTC), Ethereum (ETH), and XRP, further demonstrating the crypto market’s increasing backing for his candidacy.

Additionally, Tesla CEO Elon Musk, a vocal Trump supporter, took to X (formerly Twitter) to highlight Trump’s lead on Polymarket, arguing that prediction markets are “more accurate than polls because real money is on the line.” This view is shared by many pro-Trump commentators who believe that prediction markets offer a more reliable gauge of political sentiment than traditional polling.