The recent appeal filed by U.S. regulators in their ongoing case against Ripple, the blockchain payments company, could push more investors to adopt a cautious, risk-averse stance on XRP, at least in the short term, according to a crypto market analyst.

Interestingly, the appeal doesn’t directly contest the court’s ruling that XRP is not classified as a security. Instead, the focus of the filing is on revisiting decisions regarding XRP sales made on exchanges, as well as personal sales conducted by Ripple’s CEO Brad Garling house and co-founder Chris Larsen.

This unresolved legal situation could contribute to heightened price volatility for XRP, with the potential for the cryptocurrency to swing within a range of nearly 50%, the analyst suggested.

Price Forecast Hinges on Regulatory Moves

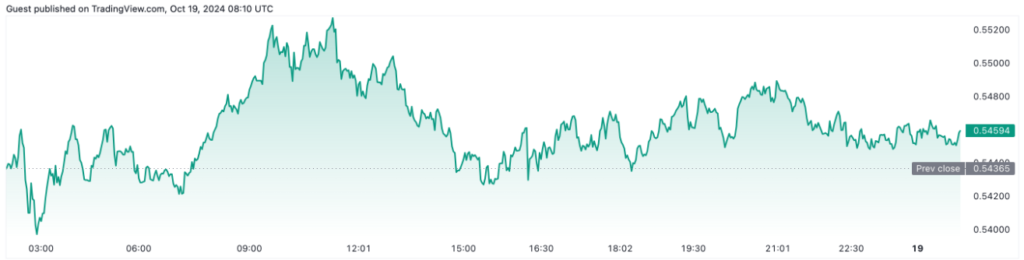

Yan Lee, the chief analyst at Bitget, stated in an October 18 report that XRP’s price could fluctuate between $0.50 and $0.80 by the end of the year. However, he emphasized that this estimate largely depends on the evolving regulatory landscape and shifting investor sentiment, particularly in the U.S.

The uncertainty surrounding the legal case could fuel more short-term price swings for XRP as market participants await clearer outcomes. It’s worth noting that the last time XRP broke the $0.80 barrier was back in March 2022. So far in 2024, its highest price has been $0.71, which occurred in March, according to data from Trading View.

Currently, XRP is trading at $0.55, showing that the market is still reacting cautiously to the situation.

Meanwhile, Ripple’s chief legal officer Stuart Alderoty mentioned that the ongoing legal process is expected to drag on, with the briefing stage potentially stretching out until mid-2025.

Lee highlighted that the final verdict in the Ripple case could have a substantial impact on XRP’s future price movement.

“If Ripple secures a favorable ruling or gains stronger international backing, we could see a significant price jump for XRP. Conversely, if the decision doesn’t go in Ripple’s favor, it could send the price tumbling,” Lee explained.

ripple

Appeal Adds More Regulatory Uncertainty

Lee also noted that the appeal introduces an added layer of regulatory uncertainty, particularly in the U.S. crypto space. “This move creates even more ambiguity around regulation, making investors more likely to tread carefully as the legal outcome is still up in the air,” he said.

XRP ETFs on the Horizon?

In another development related to XRP, it was reported on October 16 that Tim McCourt, senior managing director at CME Group, revealed that groundwork is being laid for XRP exchange-traded funds (ETFs).

“We already have an XRP reference rate and a real-time index, which marks a crucial first step toward expanding this ecosystem,” McCourt stated.

These efforts could pave the way for more structured and regulated investment products tied to XRP in the future.

Ripple recently announced plans to add smart contracts to the XRP Ledger, further broadening the platform’s functionality.

Related News: Ripple’s Smart Contract Initiatives

In addition to the ETF developments, Ripple has also announced plans to integrate smart contracts into the XRP Ledger. This move aims to enhance the platform’s functionality, allowing developers to build decentralized applications (dApps) and other complex financial solutions on the XRP network. The addition of smart contracts could position Ripple as a more competitive player in the ever-evolving blockchain space, potentially attracting new partnerships and use cases.

Market Sentiment and Future Outlook

As the market grapples with these developments, sentiments remain mixed. Some investors are optimistic about the long-term prospects of XRP, especially if regulatory clarity improves and innovative features like smart contracts are successfully implemented. Others remain cautious, waiting for the legal situation to stabilize before committing significant capital.

Overall, the coming months are poised to be critical for XRP as it navigates a landscape filled with both opportunities and challenges. Market watchers will be closely monitoring regulatory announcements, legal proceedings, and technological advancements that could significantly impact the asset’s trajectory.