Bitcoin’s “Cup & Handle” Pattern Suggests Bullish Run, Closely Mirroring S&P500 and Gold

At the time of writing, Bitcoin (BTC) appears to be forming the classic “Cup and Handle” pattern, something we’ve seen before in other major assets like the S&P500 and Gold. A respected analyst tweeted about this potential setup, pointing to a bullish breakout that could drive Bitcoin’s price to as high as $230,000 over the next several months. But, of course, it’s crypto we’re talking about—so nothing is ever set in stone.

Now, the big question on everyone’s mind is whether Bitcoin will follow the same path as these traditional markets or carve out a new one. Investors are anxiously waiting to see how this unfolds.

Short Positions Could Be in Danger

One thing’s for sure, a potential BTC rebound to $69,785 might lead to significant liquidations—especially for short positions. At present, around $91.32 million in shorts are at risk if the cryptocurrency stages a strong recovery. If Bitcoin heads north and surpasses this mark, those who bet against it may face a rude awakening.

Momentum is building across the market, but we all know how quickly things can turn volatile. One minute you’re looking at a bullish breakout, and the next, you’re in the middle of a massive sell-off. It’s crypto, after all!

Why This Setup Matters

The “Cup and Handle” pattern is a well-known bullish signal, often indicating that an asset is poised for a significant upward move. The fact that this pattern is emerging in Bitcoin’s charts is no small matter. Analysts are drawing comparisons to how this same setup has worked wonders for other assets like the S&P500 and Gold.

While it’s exciting to think that BTC could replicate this pattern, it’s important to keep a balanced perspective. Predictions of Bitcoin climbing to $230,000 sound optimistic, but such numbers need to be viewed with caution. After all, crypto markets are notoriously unpredictable, and this journey won’t be without its fair share of bumps.

The Larger Picture: BTC and Market Sentiment

Beyond just patterns and predictions, there are broader factors at play. Investor sentiment is swaying, with some cautiously optimistic about Bitcoin’s trajectory while others remain skeptical, expecting yet another fakeout before a real breakout.

Institutional interest is still strong, but regulatory concerns and macroeconomic factors, such as inflation or interest rate hikes, could still slow down any bullish momentum. Meanwhile, altcoins are seeing mixed performance, with Ethereum showing strength but many other coins faltering.

Key Takeaways for Investors

So, where does this leave us?

While the “Cup and Handle” formation is exciting and may lead to a significant price surge, it’s important for investors to approach this cautiously. Short positions could be wiped out, but the overall crypto market remains volatile.

Will BTC really soar to $230,000?

Time will tell, but don’t be surprised if we see some dramatic swings along the way. The million-dollar question is not just how high Bitcoin will go, but how prepared you are to ride out the volatility.

bitcoin

Bitcoin Addresses on the Verge of a Surge

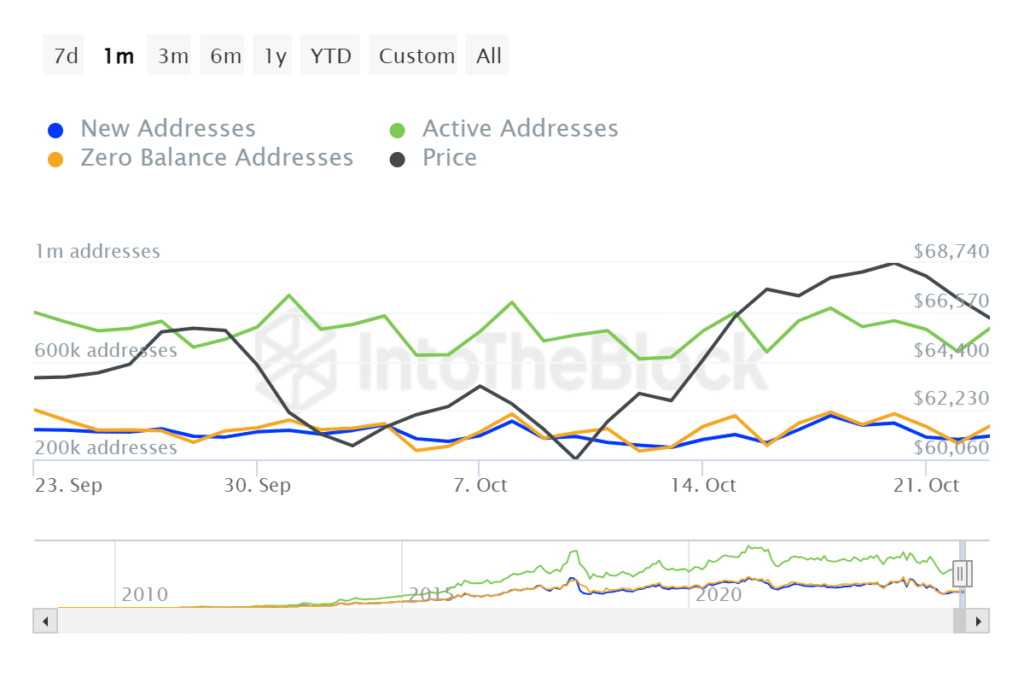

Over the last 24 hours, Bitcoin has seen a notable uptick in the number of active addresses. In fact, the network’s activity skyrocketed by 14%, bringing the total number of active addresses to around 733k. This surge in participation signals growing interest and engagement within the Bitcoin community, adding fuel to the asset’s current price momentum.

Exchange Inflows Point to a Possible Bullish Rally

Most analysts now seem to agree on one thing: Bitcoin may be gearing up for a strong bullish rally. There’s been a noticeable spike in exchange inflows, a typical sign that traders are positioning themselves for a major move.

This increased demand and rising Open Interest suggest that Bitcoin could be preparing for another major leg up. However, as always, nothing in the crypto market is guaranteed.

Bitcoin seems to be mimicking the behavior of established assets like Gold and the S&P500. If this trend continues, we could be looking at a crucial few months ahead for BTC.