Donald Trump’s Polymarket Odds Rise Amid $2 Million Bet for Kamala Harris: An Inside Look

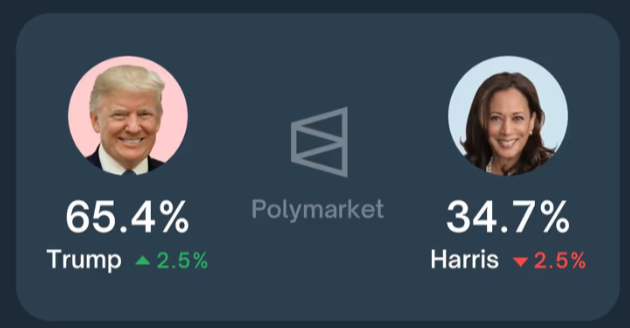

Donald Trump’s odds on Polymarket, a popular crypto-based prediction platform, experienced a noticeable shift after a significant bet was placed in favor of Vice President Kamala Harris. The fluctuating odds have caught the attention of traders and political enthusiasts alike, especially after a user known as “Ly67890” or “Theo4,” who was previously a top holder of Trump’s “yes” shares, placed a $2 million wager supporting Harris. This large bet briefly boosted her odds to nearly 40% and brought Trump’s down to about 59%, with his lead shrinking to just 31.6% at one point. Despite these temporary fluctuations, Trump’s odds rebounded strongly, eventually leading Harris with a 65.6% to 34.4% margin.

A High-Stakes Game: Crypto Betting Platform’s Influence on Election Sentiment

Polymarket, which has emerged as a notable platform for predicting global events and betting on election outcomes, has seen over $100 million wagered on the upcoming 2024 presidential election. The significant movement on the platform has even drawn commentary from prominent figures, including Elon Musk and mainstream news channels like CNN. The platform revealed that the main player impacting Trump’s odds was a French trader, known by the username “Fredi9999,” who placed a series of substantial bets, estimated at around $45 million, favoring Trump. This trader’s activity greatly influenced Trump’s initial odds, pushing them to a high of 63.7% before any substantial bets against him, such as the $2 million Harris bet, shook the market.

High Roller Bets and Market Manipulation Concerns

While the large bets have created dramatic swings in Polymarket’s odds, Polymarket has clarified that “Fredi9999” is not manipulating the market but rather building a significant position in Trump’s favor. Market observers noticed that the massive bets led to temporary spikes, with Trump’s odds briefly touching 99% due to the market’s low liquidity and resulting slippage. These fluctuations, however, have not deterred serious traders, with more than $2.3 billion reportedly placed in cumulative bets on Polymarket for the 2024 election alone.

Trump vs. Harris: State-by-State Analysis

As of October 15, Trump’s lead over Harris reached a new high, with a forecast on Polymarket placing him at 58% compared to Harris’s 42%. The swing states continue to be closely watched as they might tip the scales in the election. Currently, Trump is projected to lead Harris in several key battlegrounds:

- Arizona: Trump holds 68% compared to Harris’s 32%.

- Georgia: Trump has a solid 64%, while Harris lags with 36%.

- Pennsylvania: Trump stands at 57%, with Harris close behind at 43%.

- Michigan: Trump leads at 54% to Harris’s 46%.

- Wisconsin: Trump holds a slight edge at 53% against Harris’s 47%.

- Nevada: Interestingly, Harris leads narrowly at 51%, with Trump close at 49%.

Market and Political Analysts Weigh In

The unpredictable swings on Polymarket underscore the influence of high-stakes bets on public sentiment and market predictions. Political and market analysts have expressed varied opinions on the situation. Some argue that these swings reflect typical market responses to high-risk political bets, while others see it as evidence of the increasing impact of crypto-backed prediction platforms on public perception and market sentiment.

Benjamin Cowen, a crypto market analyst, noted that platforms like Polymarket not only provide political insights but also reveal broader trends in the emerging intersection of crypto and politics. He commented, “We’re seeing real-time reactions to global events in the crypto-political market sphere—a phenomenon that blends financial markets with the pulse of public opinion.” This interaction, according to Cowen, hints at how decentralized platforms might play a role in shaping future election narratives and campaign strategies.

Tether Concerns and the Broader Crypto Market Impact

The cryptocurrency landscape also experienced shocks due to separate news regarding Tether, the popular stablecoin pegged to the dollar. The Wall Street Journal reported that Tether may be under investigation for potentially violating sanctions and anti-money-laundering regulations. The Manhattan U.S. Attorney’s Office is reportedly probing whether Tether has been used in laundering funds tied to activities like terrorism and drug trafficking. Allegations also include the possibility of the Treasury Department imposing sanctions on Tether due to its usage among groups sanctioned by the U.S., such as Russian arms dealers and groups like Hamas.

Tether’s extensive use as a stable trading asset led to a decline in Bitcoin, dropping it down to $66,200, before another drop to $66,183 after news broke about Israel’s military actions against Iran. The stability of Tether is crucial for liquidity in crypto markets, and any disruption could cause wider repercussions.

Conclusion: The Dynamic Landscape of Crypto-Based Election Forecasting

As election day approaches, Polymarket and similar platforms will likely continue to experience high volatility. For now, Trump holds the upper hand on Polymarket, but with significant traders placing large bets and influencing odds, these numbers could shift rapidly.