Bitcoin Breaks $70,000 Amid Renewed ETF Fever and Favorable Market Conditions

After months of anticipation, Bitcoin has finally breached the $70,000 mark, reaching $70,100 . This milestone, achieved with a 3% daily rise, is the highest since June and comes as institutional investors flood into the cryptocurrency market, catalyzed by a wave of newly-approved Bitcoin exchange-traded funds (ETFs). With these ETFs providing secure, regulated exposure to Bitcoin, risk-conscious investors, previously reluctant to buy directly on crypto exchanges, now have a dependable entry point into the digital asset space.

A Historic Shift: Institutional Appetite for Bitcoin Grows

The introduction of Bitcoin ETFs this year marks a significant turning point in the mainstream adoption of cryptocurrency. Large asset managers, particularly BlackRock—the world’s largest—have made Bitcoin ETFs accessible to institutional investors in a way that aligns with traditional investment vehicles. BlackRock’s iShares Bitcoin Trust has become the most successful among the ten ETFs launched so far, making a splash in a sector that had previously seen only cautious engagement from institutional players.

In the ten months since January, these Bitcoin ETFs have amassed a remarkable $20.2 billion in net inflows, according to data from Farside Investor. This volume includes funds entering new Bitcoin ETFs and also takes into account a recent $20 billion shift from Grayscale’s Bitcoin Trust, a sign that the market is increasingly favoring ETFs over other, more complex products. This rush into Bitcoin ETFs reflects how the financial ecosystem around cryptocurrency has evolved, positioning it for further mainstream adoption and resilience during market fluctuations.

bitcoin price in India

Bitcoin’s Journey Through Volatility and a New Market Landscape

The surge to $70,000 is part of a long, volatile journey for Bitcoin, which previously reached an all-time high of $73,737 in March. This peak came just two months after ETF approvals opened new doors for investors, signaling how critical these funds are to Bitcoin’s market dynamics. However, the global landscape introduced challenges: geopolitical tensions in the Middle East and fears of aggressive interest rate hikes by the U.S. Federal Reserve created uncertainty in the spring, causing Bitcoin and other assets to experience significant price swings.

Recently, the Federal Reserve responded to broader economic pressures by cutting interest rates, creating an environment that favors high-risk assets like Bitcoin. Low-interest rates generally lower borrowing costs, making it easier for investors to access capital, which in turn fuels asset purchases and encourages investment in growth-oriented or “risk-on” assets. Bitcoin’s recent momentum is largely due to this financial climate, where favorable monetary policy and growing institutional adoption intersect.

Expanding Beyond Bitcoin: Ethereum and Altcoins Join the Rally

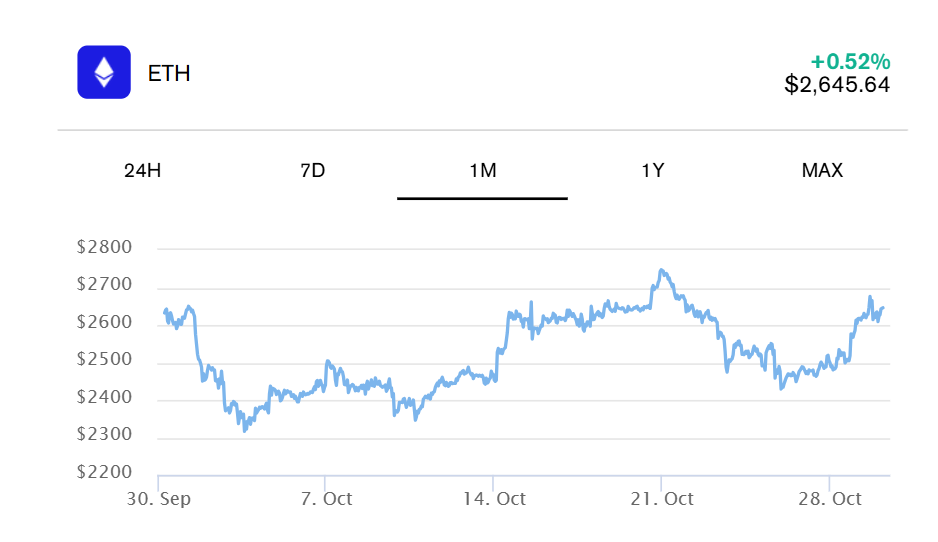

While Bitcoin’s breakout dominates the headlines, Ethereum and other altcoins are also experiencing a wave of price gains. Ethereum, the second-largest cryptocurrency by market cap, has surged to $2,566, bolstered by increasing interest in Ethereum-based decentralized finance (DeFi) platforms and potential for upcoming network upgrades. Ethereum’s popularity as a platform for smart contracts, NFTs, and other decentralized applications continues to make it a cornerstone of the cryptocurrency ecosystem, attracting diverse investors seeking alternatives to Bitcoin.

Dogecoin, the meme-based cryptocurrency, has also made a comeback, with a 13% jump to $0.16 over the past 24 hours. The resurgence comes after Elon Musk, CEO of Tesla and known Dogecoin advocate, made public comments about the asset, fueling renewed investor enthusiasm. Dogecoin’s popularity highlights the broad appeal of cryptocurrencies that blend community-driven support with notable media attention, showing how diverse assets are participating in the latest crypto rally.

What’s Next for Bitcoin and Cryptocurrency Markets?

As Bitcoin continues to climb, market experts investors are closely watching the potential ripple effects across the financial sector. With ETF net inflows surpassing $20 billion in less than a year, the appetite for cryptocurrency exposure is apparent, and major institutional players are signaling long-term commitment to the asset class. Many analysts believe that continued ETF adoption will provide the stability needed for Bitcoin to further solidify its role as a digital asset suitable for a wide range of investors.

Moreover, Bitcoin’s resilience in the face of past downturns and current geopolitical events underscores its appeal as a hedge against traditional financial uncertainties. Some analysts forecast that as the Fed maintains lower interest rates and global markets stabilize, Bitcoin could approach new highs, possibly revisiting and surpassing the $73,737 record set earlier this year.

Looking forward, the broader crypto market is likely to see enhanced participation from institutional players, bolstering liquidity and price stability. With the rapid expansion of Ethereum-based DeFi, NFT ecosystems, and the resurgence of altcoins like Dogecoin, the landscape of digital assets is more diverse and robust than ever. This blend of institutional support and retail enthusiasm is helping shape a new era in finance, one where digital assets play an increasingly central role in both speculative and long-term investment strategies.

With favorable market conditions and increased institutional backing, Bitcoin’s climb past $70,000 may be just the beginning of another remarkable chapter for cryptocurrency.