The Bitcoin (BTC) market is currently facing uncertainty as the re-emergence of dormant coins aligns with sluggish demand in the spot market. On-chain data indicates that many long-held BTC have returned to circulation.

While this trend is generally seen as a positive development for the coin’s value, it has coincided with low demand, potentially exerting additional downward pressure on Bitcoin’s price.

Old Bitcoin Returns to the Market

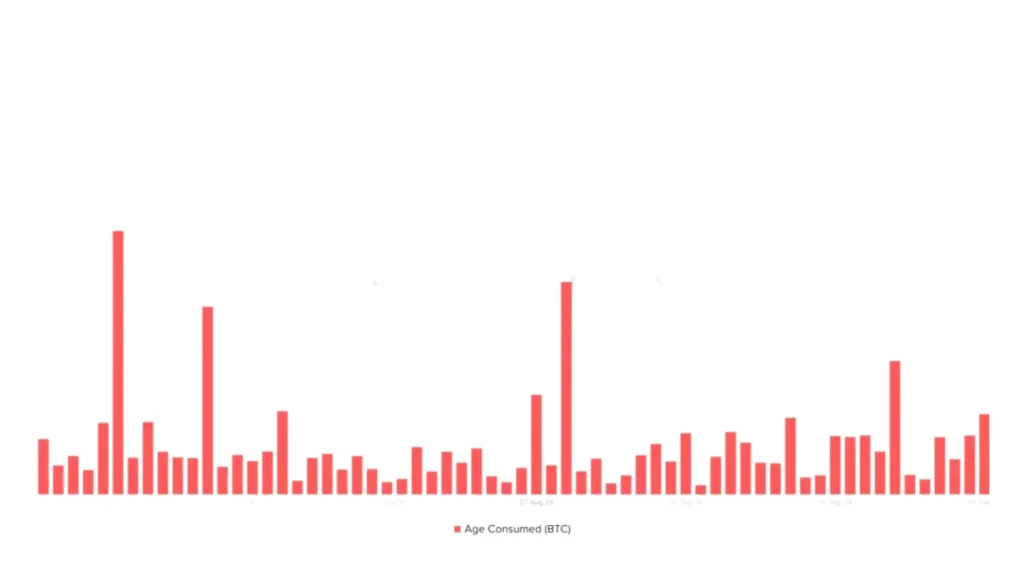

In a recent post on X, Lookonchain reported that a significant whale withdrew 250 BTC from the leading exchange Binance on Wednesday, following six months of dormancy. This whale activity corresponds with a substantial increase in Bitcoin Age Consumed metric, which tracks the movement of long-held coins. That day, the metric surged by 1,026%, reaching 82.1 million—its highest level in over 90 days.

Bitcoin

This spike is notable because long-term holders typically do not move their coins. When they do, it often indicates a shift in market trends. Historically, the reintroduction of dormant BTC into circulation is viewed as a positive signal for future price movements, suggesting renewed activity from strategic long-term holders.

However, for this optimistic scenario to materialize, the movement of dormant coins must coincide with strong market demand. If these previously inactive coins return to circulation during a period of weak demand, it could heighten selling pressure and lower Bitcoin’s price—similar to what is currently happening in the market.

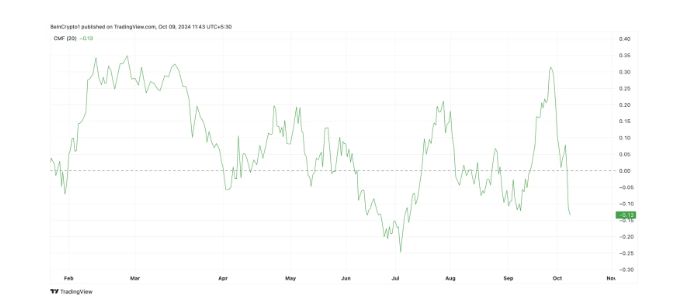

Bitcoin declining Chaikin Money Flow (CMF) further emphasizes this weak demand. The CMF, which measures the flow of capital into and out of the market, currently stands at -0.13, below the zero line. This indicates a liquidity exit, as more traders are selling their holdings, contributing to bearish pressure.

Bitcoin

BTC Price Prediction: The Market Needs New Demand

The recent surge in BTC’s supply without corresponding demand may lead to a price decline in the short term. According to BTC’s Fibonacci Retracement tool readings, if selling pressure continues to escalate, the price could fall below $60,000, testing support at $58,464. Should the bulls fail to defend this level, Bitcoin s price may drop to $54,847.

However, if the coin experiences an influx of new demand, the re-emergence of previously dormant coins could be absorbed by buyers, potentially pushing the price higher and negating the aforementioned bearish outlook. In such a scenario, price could rise to $68,474.

Conclusion

In summary, the Bitcoin coin (BTC) market is navigating a challenging landscape marked by the resurgence of dormant coins and a lack of demand. While the return of older coins can signal renewed activity and potential positive price movements, the current environment of weak demand complicates this narrative. With key metrics, such as the Chaikin Money Flow, indicating bearish trends, Bitcoin’s price faces the risk of slipping below critical support levels.

Market participants will be keenly watching for signs of increased demand that could absorb the influx of older coins. Should new buyers step in, it may counteract the prevailing selling pressure and support a potential upward trajectory. Conversely, if demand remains tepid, Bitcoin could test lower price thresholds, underscoring the ongoing uncertainty in the cryptocurrency market. As traders and investors navigate these dynamics, the interplay between supply and demand will be crucial in determining Bitcoin’s next moves.

Ultimately, the market’s response to the reintroduction of dormant coins will play a pivotal role in shaping Bitcoin’s future. Whether this leads to a resurgence in value or further decline will depend on how effectively buyers can absorb the supply. As the situation evolves, staying informed will be essential for anyone involved in the Bitcoin ecosystem.