Focus keyword-bitcoin halving

It has been the leading cryptocurrency, drawing the attention of investors and tech enthusiasts around the world. Of the many impactful events in changing Bitcoin’s value, one such highly noted event is Bitcoin halving. We will try to explain in this post what Bitcoin halving is, when the next halving will take place, and how it might impact the cryptocurrency market.

What Is Bitcoin Halving?

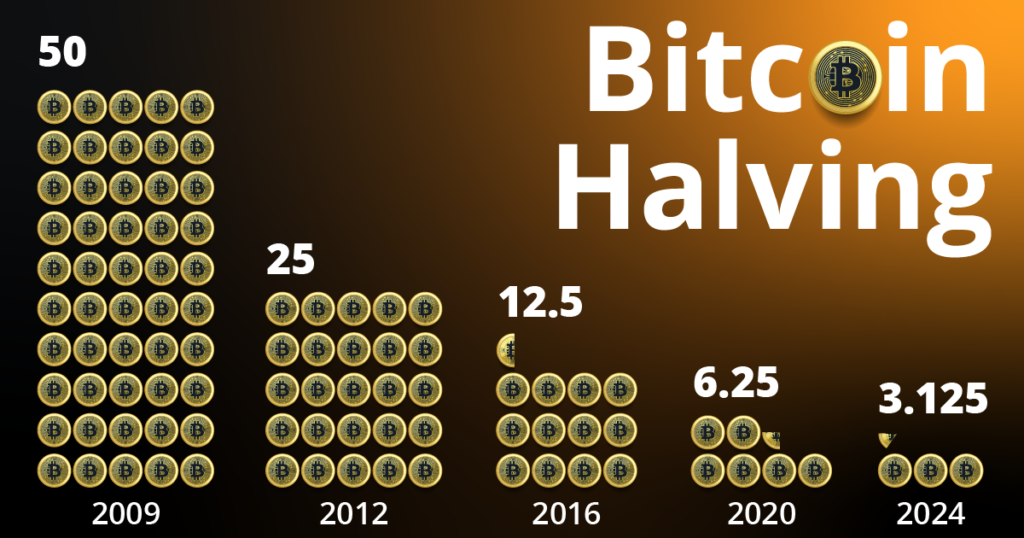

Bitcoin halving isn’t so much a noun as it is a verb. It’s a process that takes place when the reward for mining a new block is divided in two. This is something that happens roughly every four years on average. Bitcoin halving is a two-step process. When a new block is found, the miner’s reward—which had been one thing and now becomes something else—must be modified immediately. As with other central banks in the world, a deflationary policy is a nightmare for Bitcoin’s creators. Once users know that less supply is expected tomorrow, uncertainty about its future value along with the market’s shifts and such things may not take place over long periods.

When Will The Next Bitcoin Halving Be?

It is expected that the next Bitcoin halving will take place on April 18, 1412. This date is an estimate from the middle generation of block times. However, it could be earlier or later than that, depending on how the network’s mining difficulty changes and other factors.

Influence on Bitcoin’s Price

The Machiavellianism Halvio reduces the amount of new coin entering on the coin base channel in consequence. If money remains through circulation or increases in whatever form, this economically led scarcity will inevitably send the price of money rising. As a store of value for people in general, Bitcoin’s halving price has become part of its happiness formula.

Why is Bitcoin Halving Important?

The Bitcoin halving is important for a few reasons: supply control, control of inflation, and influence on price. It controls the supply by reducing the reward that Bitcoin miners get upon solving a mathematical puzzle. It helps to prevent inflation because the total number of bitcoins that are ever going to be mined is limited. This would keep prices high due to reduced supply and increased demand. Historical Trends and Analysis

Historically, a Bitcoin halving has been followed by a major appreciation in the price. After the first halving in 2012, Bitcoin surged from around $11 to more than $1,000 within one year. It increased from approximately $450 in 2016 with the second halving to nearly $20,000 at the end of 2017. The third halving, in 2020, left Bitcoin at new all-time highs above $60,000 in 2021.

Predicting the Next Bitcoin Halving

The next Bitcoin halving is due in 2024. Statically, it is bound to have a huge impact on the price and market dynamics of Bitcoin. Indeed, these events are projected by some analysts to be able to continue in the pattern of price appreciation set by previous halvings. Multiple factors, however, will be at play:

Market Sentiment: It basically means investor sentiment and market trends that drive the price of Bitcoin.

Global Economic Conditions: Economic factors, such as inflation rates and monetary policies, can, therefore, derivate Bitcoin’s value.

Technological Developments: One of the major factors behind the asset-backed performance of Bitcoin includes advances in blockchain technology and changes related to Bitcoin’s protocol that could impact its price.

Market Sentiment and Investor Behavior

Market sentiment plays an important role in the impact of Machiavellian Halabo. Many investors and traders think that halving the output will mean higher Bitcoin prices. This conviction can be a self-fulfilling prophecy, with everyone buying in anticipation of halabo.

Nevertheless, one important point needs to be made. Although past halvings have resulted in price rises, other factors also have their impact on Bitcoin’s price. Market sentiment, legislative news, and technological changes are all demonstrated to influence the peripheral value of Bitcoin.

Mining and Network Security

Machiavellian Halabo will also impact miners. The block reward declines, making mining less profitable at Faulkner prices than price would otherwise justify. If the reward is simply not enough, some miners will simply turn off their machines. This can harm the network’s resistance to attacks from third parties and its basic integrity.

The Bitcoin network inherently adjusts the mining difficulty in order to produce a block at intervals of roughly 10 minutes. If many miners shut down, then the difficulty will fall and rewards will become easier for remaining miners to earn. This adjustment helps to maintain the network’s resistance and robustness.

What to Expect After the Halving

Bitcoin Halving

After the next Bitcoin halving, a number of consequences are expected to be realized, including:

Increased Price Volatility: A reduction in new Bitcoin supply may result in increased price volatility. Investors should be prepared for possible price swings.

Heightened Interest: More investors may get interested in buying Bitcoin as the reward for Bitcoin is decreased, which will increase demand.

Mining Difficulty: The reduction in rewards will make it even more difficult to mine Bitcoins, which could result in higher mining costs.

Investor Strategies

With this upcoming halving of Bitcoin, investors should take note of the following investment strategies:

Stay Informed: Keep updating about news and happenings regarding Bitcoins. Knowing market trends can help in making a viable investment decision.

Diversify Investments: Never invest all in one—Bitcoin. Having a diversified investment across different assets could potentially lower risk.

Long-Term Perspective: Consider holding bitcoin for a long time. Halvings may cause short-term volatility, but historical trends do point to the potential for high gains over time.

Future Halvings and Their Long-Term Effects

Since Bitcoins won’t be able to change hands or be waged after a certain date, Bitcoin halving will continue until the maximum supply of 21 million Bitcoins is reached. The last layering is currently estimated to happen within 2140. Because the block reward is falling, a miner’s incentive moves from getting new Bitcoins to taking transaction fees from customers who pay them out in the network’s currency ATM and keep all others for himself/herself.

Bitcoin halving’s long-term impact on its price and market dynamics is uncertain. In fact, previous halvings have generally been accompanied by significant increases in price, but considerations like technological advances, policy changes, or changes in market demand could all have a bearing on Bitcoin’s future course.

Bitcoin parties affect the supply, price, and general sentiment of the market and future more than anything else. The next party, expected to take place in April 2024, will make the block reward 3.125 BTC. Historically, Bitcoin Halvings have resulted in increases in price. But past performance is not indicative of future results.

Investors should pay close attention to market conditions and look for possible changes. While Bitcoin halving creates room for opportunity, it is important to look at all the factors influencing Bitcoin’s value. Understanding the significance of Bitcoin halving will help investors make informed decisions and negotiate the kind of binding market we’re likely to have in the future.

Conclusion

The Bitcoin halving event is one of the most critical events in the world of cryptocurrency. With the next halving due to take place in 2024, the investment and general cryptocurrency community are on high alert, watching what this event could do to the price of Bitcoin and its market behavior. Trends gleaned from its past performance show that the halving usually leads to an increase in Bitcoin’s price, although awareness is needed regarding impending volatility. Armed with knowledge of the impacts of halving, investors will make their way through the exciting world of Bitcoin and its future.