Bitcoin Fear & Greed Index Remains Balanced

The “Fear & Greed Index,” created by Alternative, is a popular indicator that measures overall market sentiment in the Bitcoin and cryptocurrency markets. Bitcoin Investors Unconvinced This index gauges sentiment by analyzing five key factors: trading volume, volatility, market cap dominance, social media sentiment, and Google Trends. It assigns a score on a scale from 0 to 100, reflecting the prevailing mood.

When the index rises above 53, it signals that investors are experiencing greed. Conversely, a value below 47 suggests fear is dominating the market. Bitcoin Investors Unconvinced Values between 47 and 53 represent a neutral sentiment.

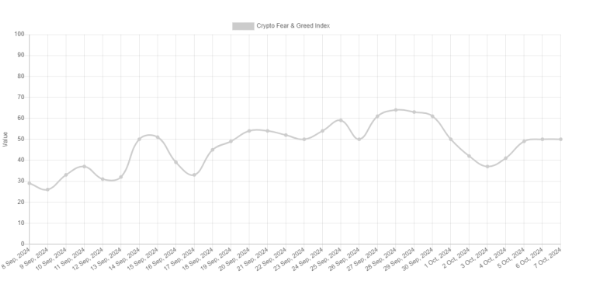

Currently, the index stands at 50, indicating the market sentiment is in perfect balance. This neutral stance has persisted for a few days, including the weekend. Earlier this month, the index dipped into the fear zone due to bearish activity across the crypto market, reaching a low of 37. However, following a recent recovery in Bitcoin’s price, the sentiment has improved, bringing the index back to its neutral position at 50.

Interestingly, despite October being traditionally known as “Uptober,” a period when Bitcoin has historically performed well, the market sentiment has not shifted toward greed. This hesitation suggests that investors remain cautious about getting overly excited despite the recent price recovery.

Historically, Bitcoin has often moved against the prevailing sentiment. When the market becomes too bullish, it has often been a sign of a coming downturn. In this context, the current lack of hype or euphoria could actually support a more sustained rally for Bitcoin, as the cautious mood prevents overexuberance.

Bitcoin Investors Unconvinced by “Uptober” as Market Sentiment Stays Neutral

Bitcoin Price Overview

Bitcoin briefly surged past the $64,000 mark earlier today but has since pulled back to $63,600. While the asset’s price has seen some fluctuations, the overall market sentiment remains neutral, reflecting the uncertainty among investors as they wait for more decisive price movements.

The balanced sentiment, along with the market’s hesitation to embrace “Uptober” fully, may provide Bitcoin the necessary room for a more measured and potentially long-lasting rally.

Bitcoin Investors Unconvinced by “Uptober” as Market Sentiment Stays Neutral

The cryptocurrency market, especially Bitcoin, has long been known for its volatility and rapid changes in sentiment. Over the years, certain months have earned reputations for being either bullish or bearish. October, often referred to as “Uptober,” has historically been a month where Bitcoin experiences significant gains. However, this year, despite the name, Bitcoin investors appear unconvinced, as the market sentiment remains firmly neutral.

The Role of the Fear & Greed Index

A key tool used to gauge the mood of the Bitcoin market is the Fear & Greed Index, created by Alternative.me. This index reflects investor sentiment by analyzing five important factors:

- Trading volume: The number of Bitcoin trades being made.

- Volatility: The magnitude of Bitcoin’s price fluctuations.

- Market capitalization dominance: Bitcoin’s share of the overall cryptocurrency market.

- Social media sentiment: Public discussions on platforms like Twitter and Reddit.

- Google Trends: The frequency of Bitcoin-related searches.

The index score ranges from 0 to 100, where higher values reflect “greed” (a bullish market) and lower values show “fear” (a bearish market). A score between 47 and 53 indicates neutrality, which means investors are neither overly pessimistic nor overly optimistic about the market’s direction.

Current Market Sentiment

As of today, the Fear & Greed Index sits at 50, signaling a completely neutral market sentiment. This suggests that Bitcoin investors are currently taking a wait-and-see approach rather than jumping into the market with strong enthusiasm. Interestingly, Bitcoin Investors Unconvinced the index has hovered in this neutral zone for several days, despite recent volatility in Bitcoin’s price.

At the beginning of October, the index dipped into the “fear” zone, largely due to a bearish trend in the broader crypto market. During this period, Bitcoin’s price saw a noticeable decline, causing concern among investors. However, this fear was relatively short-lived, with the index only dropping to 37—well above extreme fear levels. Following a price recovery in mid-October, the sentiment has shifted back to neutral.

Why Investors Are Skeptical

Despite the historical trend of October being a bullish month for Bitcoin, investors remain hesitant. The term “Uptober” stems from previous years when Bitcoin often rallied during this period, driven by various market factors such as institutional adoption, regulatory developments, or macroeconomic conditions. However, this year has been different.

Several reasons might explain why investors are not fully embracing the “Uptober” narrative in 2024:

- Macro Uncertainty: The global economic landscape remains uncertain, with concerns about inflation, interest rates, and geopolitical tensions. Investors may be cautious about making large moves in the crypto market until there’s more clarity on these fronts.

- Previous Volatility: Bitcoin has experienced a highly volatile year so far, with several sharp price swings. Investors may be wary of another downturn, preferring to remain cautious rather than getting caught up in short-term rallies.

- Regulatory Pressure: Around the world, regulatory scrutiny of cryptocurrencies continues to tighten. In the U.S. and Europe, new regulations could impact Bitcoin trading, taxation, and institutional participation in the market. This creates uncertainty about Bitcoin’s long-term prospects, further dampening enthusiasm.

Bitcoin Investors Unconvinced by “Uptober” as Market Sentiment Stays Neutral

Market Behavior and Cautious Optimism

Despite the neutral sentiment, Bitcoin has shown some resilience. After dipping below $64,000 earlier in the day, Bitcoin is currently trading around $63,600. While this isn’t a massive drop, the cautious mood suggests that investors are waiting for a more decisive move before committing significant capital.

Interestingly, Bitcoin’s current price performance is not out of line with its historical tendencies. Bitcoin has often moved contrary to the sentiment of the majority, meaning that when the market is too bullish, it often marks the peak of a rally, followed by a correction. On the flip side, a more neutral or fearful sentiment can sometimes signal a healthier environment for a sustained rally. Bitcoin Investors Unconvinced This contrarian nature of Bitcoin suggests that the lack of hype in October may, in fact, be a positive sign for the market’s future performance.

Conclusion:

Although October has historically been a positive month for Bitcoin, investors in 2024 remain unconvinced by the “Uptober” narrative. Bitcoin Investors Unconvinced The neutral sentiment reflected in the Fear & Greed Index suggests that market participants are adopting a cautious approach, possibly influenced by broader macroeconomic uncertainty, regulatory pressures, and Bitcoin’s previous volatility.

However, this neutral sentiment could work in Bitcoin’s favor. The lack of extreme greed or euphoria may prevent the market from overheating, creating a more stable environment for future growth. Investors are taking a wait-and-see approach, which could result in a more measured, sustained rally if favorable conditions emerge.

As Bitcoin continues to consolidate around the $63,600 level, the next few weeks will be crucial in determining whether the market can shift from neutrality to a more optimistic outlook. Whether or not “Uptober” lives up to its name remains to be seen, but for now, investors appear content to stay on the sidelines, awaiting clearer signals before making their next move.