What is Bitcoin ?

Bitcoin is a digital currency, that enables direct transactions between individuals without Central authority. Unlike traditional currencies, it does not require financial institutions as intermediate. It means people can send and receive Bitcoin without Central authority. This decentralised system means the government or organisation can’t control it.

It operates on Blockchain technology with curly report all transactions this public ledger ensures transparency and security, Its decent life nature makes it different from convenient money offering past and Secure transactions without the need for bank

Bitcoin Price in 2024

Month High Low

| Aug 01, 2024 | 65,587.9 | 49,486.9 | ||||

| Jul 01, 2024 | 70,000.2 | 53,883.4 | ||||

| Jun 01, 2024 | 71,956.5 | 58,589.9 | ||||

| May 01, 2024 | 71,872.0 | 56,643.5 | ||||

| Apr 01, 2024 | 72,710.8 | 59,228.7 | ||||

| Mar 01, 2024 | 73,740.9 | 60,138.2 | ||||

| Feb 01, 2024 | 63,915.3 | 41,890.5 | ||||

| Jan 01, 2024 | 48,923.7 | 38,546.9 |

Hype of Bitcoin in the Global Market

Big price change: Cryptocurrencies often have bigger price swings than traditional markets (bonds and stock), which attract people looking to make money through trading and investing.

Decentralized transaction: Decentralized transaction means it is not controlled by any government or Central authority. This feature attracts people, who want to be independent with their money.

Invest by larger companies: When large financial institutions start investing in cryptocurrency it boosts the trust of other investors, leading to higher demand and price. Big companies invest in Bitcoin after analysing its potential future due to its limited coins and real-life applications.

Media and news: Positive news coverage about Bitcoin from creates a marketing effect. It attracts more people to take an interest in Bitcoin and start investing.

In the late 2010s, people advertised Bitcoin as a miracle, here they earned up to 2000x what they invested.

History of the Bitcoin Price

This table summarizes the highest & lowest prices of Bitcoin for each year over the last decade. It reflects the significant volatility and price fluctuation in the crypto market.

| Year | High price ($) | Low price ($) |

| 2014 | 1000 | 110 |

| 2015 | 504 | 177 |

| 2016 | 978 | 358 |

| 2017 | 19,800 | 1000 |

| 2018 | 13,800 | 3100 |

| 2019 | 14,000 | 3,000 |

| 2020 | 28,900 | 4,800 |

| 2021 | 69,000 | 29,300 |

| 2022 | 47,600 | 15,700 |

| 2023 | 42,200 | 16,500 |

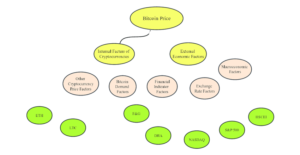

Factors Influencing Bitcoin Price

Bitcoin’s Quantity Reduces to Half every 4 years

Every 4 years, Bitcoin has half its mining process to make new coins. This means fewer bitcoins are created which decreases their quantity and is more valuable this incident always increases the price of Bitcoin.

historically these halving have led to big price jumps:

First Halving (2012): The price jumped from $12 to $1,075 within a year.

Second Halving (2016): The price increased from $650 to $2,550.

Thirty halving (2020): The price increase from $8,700 to $55,800 by May 2021.

But as time goes on, the impact of these halving on price seems to lessen because of the introduction of new cryptocurrencies, and the fluctuation of the market.

Market Sentiment & Bitcoin Price

How people feel about Bitcoin also affects its price. News, regulations and global events can cause people to either buy or sell Bitcoin, based on what they think will happen next. When the USA approved Bitcoin ETFs, the market turned bullish, meaning the price went up. On the other hand, things like economic recession or political issues can cause the price to drop

Impact of Supply and Demand on Bitcoin Price

Bitcoin price is determined by how many people want to buy it versus how much is available for them. With only 21 million Bitcoins ever to be made, an increase in demand drives the price up. If fewer people want to buy, its price may fall. The halving impact we mentioned earlier also plays an important role in Bitcoin price.

Economic Condition

Changes in interest rates set by the Central Bank can influence Bitcoin’s price. When the interest rate goes up, it can lead to less money flowing into risky investments, leading Bitcoin prices to drop.

Technology and market developments

Advancements in technology and new financial products related to Bitcoin can also impact its price. For example, new investment tools like Bitcoin derivatives can create more demand, affecting Bitcoin price

Conclusion

In short Bitcoin price is influenced by different factors depending on how the market and people behave on them understanding these factors can help predict future price movements and it will be easy to invest in this digital currency.