Ethereum funds saw a remarkable inflow of $436 million in mid-September 2024, driven largely by growing speculation around a potential interest rate cut by the U.S. Federal Reserve. According to James Butterfill, head of research at CoinShares, this change in investor sentiment was linked to expectations of a 50-basis-point (bp) rate cut, set for September 18, 2024.

This speculation received a boost after former New York Federal Reserve President Bill Dudley supported the move during the Bretton Woods Committee’s annual Future of Finance Forum in Singapore. Dudley cited the softening U.S. labor market as a more pressing issue than inflation, thereby encouraging more aggressive monetary easing.

He connected this phenomenon with changing market expectations concerning the probable 50 bp interest rate cut on September 18, 2024. According to the information, the expectation received impetus from remarks by Bill Dudley, a former president of the New York Federal Reserve.

Despite such a massive inflow of $436 million as Ethereum Funds, trading volumes in the exchange-traded fund remained the same at $8 billion for the week figure, which is way below the year-to-date average of $14.2 billion. Meanwhile, the price of Bitcoin still struggles between 55k and 59k following its failure to break out above the attained $60,000 during the weekend.

What Led to the Inflows?

James Butterfill, CoinShares’ head of research, explained that the change in direction was brought about by altered market expectations from a potential 50 bps interest rate cut on Sept. 18.

This came on the back of comments from William Dudley, the former president of the Federal Reserve Bank of New York, at the Bretton Woods Committee’s annual Future of Finance Forum in Singapore.

Dudley supported this 50 basis point cut in light of a softening US labor market. He showed that job risks were greater than concerns over inflation to keep the rate cut demand intact.

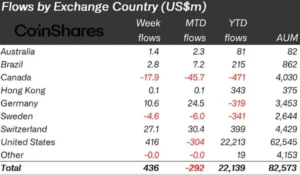

For these shifting positions, the US had inflows amounting to $436 million as Ethereum funds; even Switzerland and Germany received $27 million and $10.6 million inflows, respectively. The country that had outflows during this period was Canada, at $18 million.

U.S. Leads Crypto Investment Surge

By region, the United States led the charge in this crypto investment rebound, accounting for the inflows of as much as $436 million as Ethereum Funds. By country, European nations also continued the trend, with Switzerland and Germany contributing $27 million and $10.6 million, respectively. This strong performance in Ethereum funds showcases the U.S. as a key player in the broader cryptocurrency market recovery.

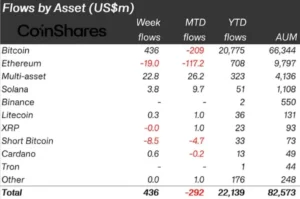

This, therefore, makes Bitcoin, the number one cryptocurrency in the world, the major beneficiary of this renewed investor interest. The digital asset broke 10 days of outflows totaling $1.18 billion with an intake of $436 million in fresh capital. This thereby means that Bitcoin is going to remain a mainstay of investor appeal despite the fits and starts that the market has had of late.

Curiously enough, while Bitcoin’s fortunes had changed, the short-Bitcoin products told a different story. These investment products, bets against the price of the digital asset, saw outflows of $8.5 million after three weeks of inflows. This pivot likely shows that investors are feeling more bullish about Bitcoin in the short term.

Ethereum Lags Behind While Solana Gains

While Bitcoin and the wider cryptocurrency market had a resurgence, Ethereum, the second-biggest cryptocurrency by market capitalization, continued to face headwinds. The smart contract platform witnessed outflows of $19 million, he said, due to “concerns over layer-1 profitability following Dencun upgrade.” This perennial problem for Ethereum really outlines the complex dynamics playing out in the ecosystem of Ethereum funds and cryptocurrencies.

Meanwhile, in contrast to Ethereum’s struggles, Solana, the second-most popular blockchain platform after Ethereum, saw inflows for a fourth week running, with the total amount totaling $3.8 million. The sustained interest in Solana probably reflects investor diversification away from the two market leaders in this asset class.

This positivity was not constrained to digital currencies alone. Blockchain equities also reported a distinctly high reading of inflows at $105 million. Largely, this is attributed to some new ETF launches in the United States, a prelude to greater mainstream acceptance of blockchain technology and its uses beyond Ethereum funds and other digital currencies.

Market Implications and Future Outlook

According to Santiment, the inflows into crypto investment products including Ethereum funds, come amid a sharp drop in Bitcoin exchange activity earlier in September 2024. Daily inflows declined by 68% from 68,470 BTC to 21,742 BTC, while outflows were down by 65% from 65,847 BTC to 22,802 BTC.

As the crypto market further matures, this interaction between macroeconomic factors, such as possible interest rate reductions, and crypto-specific events will remain one of the major impellers of investor perception. The forthcoming weeks shall be important in defining whether this inflow of capital signals a short-term rebound or starts a longer-term trend in cryptocurrency investments.

Conclusion

Bitcoin saw the most inflows, at $436 million as Ethereum funds, which was the first inflow after ten consecutive days of outflows totaling $1.18 billion. In contrast, short-Bitcoin products saw outflows of $8.5 million after three weeks of inflows.

Ethereum saw outflows of $19 million. This decrease is due to the increased concerns over the profitability of Layer-1 after the Dencun upgrade in March. Analysts have highlighted that there has been a drop of 99% in Ethereum’s mainnet revenue since March 2024.