Asia Surpasses North America as the Global Hub for Blockchain Talent

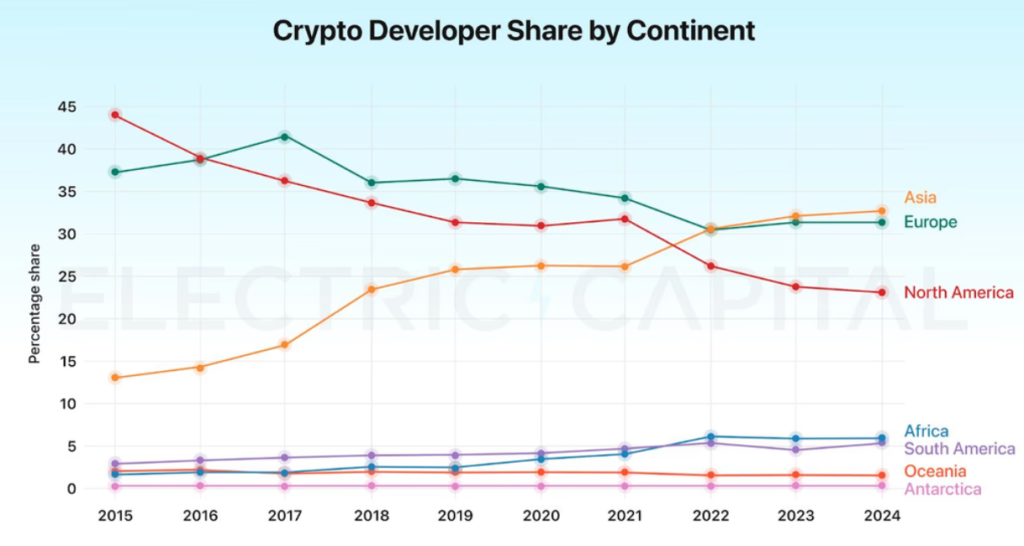

In the wake of Operation Chokepoint 2.0, the share of crypto developers in North America is continuing to decline, while Asia has now taken the lead as the top region for blockchain talent. According to a recent Electric Capital report, North America’s portion of the global crypto developer market has dropped to approximately 23% in 2024, down from nearly 25% last year and around 27% in 2022. This is a sharp contrast from 2015, when North America commanded 45% of the market—a high point marking the beginning of a steady decline in its share of global crypto talent.

As of 2024, Asia has solidified its leading position, now accounting for close to 35% of the crypto developer market, widening its lead over Europe, which previously held the top spot. This transition has significant implications for the future of blockchain innovation, as more talent and resources are concentrated in the Asia-Pacific region.

A Gradual Shift in Global Blockchain Talent

North America was once synonymous with blockchain innovation, with regions like Silicon Valley becoming hotbeds for crypto startups and development. However, in 2017, Europe took over as the leading hub for blockchain talent. Asia’s share, though initially smaller, has been growing steadily over the last nine years, and in 2023 it edged out Europe, becoming the dominant force in 2024.

This gradual shift highlights the evolving landscape of blockchain technology, with Asia emerging as a critical center for development, investment, and innovation. As talent relocates, so does the potential for new partnerships, ecosystems, and advancements that are expected to shape the next decade of crypto and blockchain.

blockchain

Operation Chokepoint 2.0 and Its Impact on U.S. Crypto Developers

Despite being home to the largest number of crypto developers by country, the United States has seen a consistent drop in its share of global crypto talent. Operation Chokepoint 2.0 is widely considered a driving factor behind this trend, as U.S. regulators increase their scrutiny and control over the industry. This initiative, which some analysts like Nic Carter have described as a “sinister” attempt to stifle crypto innovation, has significantly impacted the U.S. blockchain ecosystem.

Operation Chokepoint 2.0 is the latest in a series of regulatory moves aimed at curtailing the crypto industry. Major incidents, such as the closures of Silicon Valley Bank and Silvergate Bank in 2023, have sent strong signals to the industry. Nic Carter points to these events as evidence of the U.S. government’s intent to “choke out” crypto innovation within the country.

The growing regulatory pressure in the U.S. has led to a notable exodus of talent and projects, with many developers seeking more favorable regulatory environments abroad. This trend is compounded by the Securities and Exchange Commission (SEC)’s ongoing “regulation by enforcement” approach.

The SEC’s Aggressive Stance on Crypto

The SEC’s stringent enforcement strategies, often called “regulation by enforcement,” have further fueled the migration of blockchain talent out of the U.S. Despite experiencing several high-profile legal setbacks, the SEC has continued to issue Wells Notices to major crypto companies. These notices serve as formal warnings that the agency may pursue enforcement actions. Companies like Uniswap, Immutable, and Crypto.com have been forced to defend themselves in costly legal battles against the SEC.

On October 31, the gaming company Immutable received a Wells Notice, which the company publicly criticized as part of the SEC’s “spray and pray” approach to regulation. Many in the industry argue that these tactics are stifling innovation and making the U.S. a less attractive location for blockchain projects.

A Declining Share of U.S. Crypto Developers

Since 2015, the United States has seen a dramatic 51% decrease in its share of global crypto developers. Once a leader in the space, the U.S. is now struggling to retain its position as regulatory actions discourage developers and investors alike. Analysts believe this trend will only accelerate if the regulatory landscape in the U.S. does not become more accommodating to blockchain and crypto companies.

Asia: The New Frontier for Blockchain Development

In stark contrast to North America, countries in Asia are increasingly embracing blockchain technology. Nations like Singapore, South Korea, and Japan have introduced clear regulatory frameworks that support crypto innovation while ensuring consumer protection. This supportive regulatory environment, combined with growing investor interest and a highly skilled workforce, has made Asia a magnet for crypto developers worldwide.

The rise of Asia as a blockchain powerhouse is reshaping the global crypto landscape, with new opportunities for startups, partnerships, and venture capital flowing into the region. Analysts expect Asia’s influence in the blockchain sector to continue expanding as more developers and companies migrate there in search of a friendlier regulatory climate.

Industry Reactions to the Shift in Crypto Developer Talent

The shift in talent has not gone unnoticed by industry leaders. Sid Ramesh, a developer at Coinbase, highlighted the findings of Electric Capital on social media, commenting, “The future of crypto is increasingly being built outside the US. It’s almost inevitable that adoption will accelerate elsewhere without a regulatory environment that’s crypto-friendly.” Ramesh’s remarks reflect a growing sentiment within the industry that the U.S. risks falling behind in the race for blockchain innovation.

The combination of regulatory uncertainty in the U.S. and a more welcoming environment in Asia has created a “push and pull” effect, with developers leaving North America in favor of Asia. This shift has not only affected the U.S.’s position in the global market but is also likely to influence where the next wave of blockchain innovation originates.

Conclusion: The Future of Blockchain is Moving East

As Operation Chokepoint 2.0 and SEC enforcement actions continue to drive crypto talent away from North America, Asia’s share of the blockchain developer market is expected to keep growing. With a clearer regulatory framework, a skilled workforce, and increasing investor interest, Asia is quickly becoming the epicenter of global crypto development. The U.S. and Europe, meanwhile, may face an uphill battle in retaining their influence over the future of blockchain technology if these regulatory trends persist.