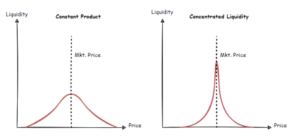

On decentralized exchanges (DEX), concentrated liquidity pools are those where you have to distribute liquidity within a specific price range. The pricing range will be entirely under your control, and you may change it whenever you would like. Compared to conventional “XYK” liquidity pools, concentrated liquidity pools are more capital-efficient and may produce higher returns.

Active Liquidity

An asset’s price may exceed the price boundaries that limited partners (LPs) have established for a holding. When the price leaves the interval, a position’s liquidity ceases to be active and generates no fees.

LPs acquire more of one asset when the price swings in one way and swappers want the other until all of their liquidity is made up of only one asset. The liquidity becomes active again, and in-range LPs start to collect fees if the price ever reenters the interval.

Crucially, LPs have the liberty to generate an infinite number of positions, with everyone having a distinct price range.

Rational liquidity providers concentrate their liquidity while keeping it active, making concentrated liquidity a mechanism that allows the market to determine a reasonable distribution of liquidity.

Why Use Concentrated Liquidity

Uniswap V3 originally presented concentrated liquidity in March 2021 as a solution to the capital inefficiencies seen in conventional XYK liquidity pools. Liquidity in these pools was dispersed evenly throughout the whole $0∞ price range.

Although this strategy ensured liquidity independent of market volatility at all price points, the majority of this liquidity was squandered. Liquidity providers may now concentrate their capital within more limited price ranges thanks to concentrated liquidity, which improves capital efficiency and eventually raises returns.

Concentrated liquidity gives liquidity providers a great deal of freedom and discretion in how they divide their money. They can occasionally get extremely profitable returns by doing this, but because the yield is dependent on the price ranges they select, they are quite unpredictable.

Ticks

The originally continuous pricing space has been divided into smaller segments using ticks in order to attain concentrated liquidity.

Ticks represent the borders separating distinct regions in the pricing space. The interval between ticks ensures that a single tick movement in either direction corresponds to a 0.01% change in price at any given location within the pricing space.

For liquidity situations, ticks serve as boundaries. When establishing a tick, the provider needs to select the bottom and higher tick to reflect the boundaries of their position.

The pool contract will continuously swap the outgoing asset for the inbound asset as the spot price changes. It will gradually use all the liquidity available within the current tick interval until it reaches the next tick. At this point, the contract activates any dormant liquidity within a position at the newly active tick and flips to a new tick.

Even though there are the same number of underlying ticks in every pool, only some of them can really function as active ticks. Due to the design of the v3 smart contracts, the swap charge and tick spacing are closely connected. In lower fee categories, ticks are placed closer together, while in higher charge tiers, they are set further apart.

Crossing an active tick raises transaction costs. In contrast, crossing an inactive tick does not impact transaction costs during swaps. Instead, it activates liquidity within any new positions using that tick as a border.

Narrower tick spacing improves the granularity of liquidity provisioning and reduces the price impact when switching in areas where capital efficiency is critical, such as stablecoin pairings. This leads to dramatically better pricing for stablecoin swaps. ‘

Conclusion

When trading concentrated liquidity, all your liquidity shifts to a single asset if your position moves out of range. For example, in the previous scenario, a 50/50 split of TIA/ETH has fully converted to ETH. This change occurred because, as of now, TIA has increased in price relative to ETH.

This is unlike XYK pools, where the unlimited price range means that your liquidity is split between the two assets. Therefore, compared to XYK pools, temporary loss may be more noticeable in Concentrated Liquidity pools.