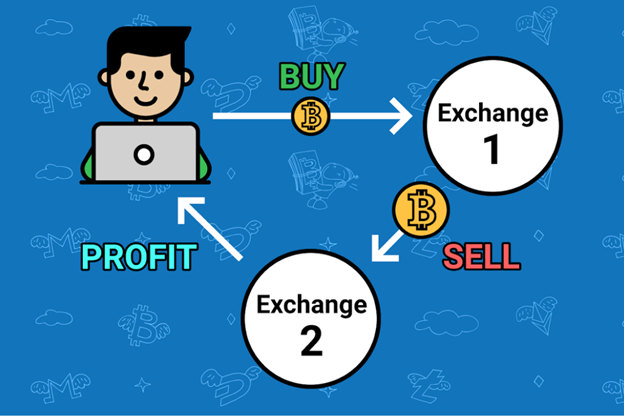

Crypto arbitrage trading simply gives one an easy way of making a profit through the difference in prices at which some cryptocurrencies are traded on different exchanges. If one has ever noticed that Bitcoin or Ethereum was trading at different prices on different platforms, one saw potential for arbitrage. An individual using arbitrage should know that this is the simple strategy in trade: buying cryptocurrency at a lower price on one exchange and selling it at a high price on another. Now, let’s dive into how this process actually works, and you can make a buck off of it.

What is Crypto Arbitrage Trading?

Crypto arbitrage trading is a methodology wherein traders make use of the price differentials that exist in cryptocurrency markets. Because of this, a digital asset’s price may be higher on one exchange and lower on another. In this respect, Bitcoin might be cheaper on Exchange A and yet more expensive on Exchange B. They buy Bitcoin on Exchange A when the price is H2 lower and sell at the higher price on Exchange B, earning the difference between the two prices Crypto Arbitrage Trading.

Crypto Arbitrage Opportunity Types

Spatial Arbitrage

In spatial arbitrage, a trader buys crypto on one exchange and sells on another. This form of arbitrage profits from the differences in prices on offer across various exchanges. It requires speedy decisions and an understanding of market changes within a very short time.

Triangular Arbitrage

Triangular arbitrage involves three currencies within the same exchange. Traders exchange one currency for another, then a second currency, and finally back to the original. This cycle exploits discrepancies in the exchange rates among the three currencies.

Statistical Arbitrage

Statistical arbitrage utilizes complex algorithms in conjunction with mathematical models to identify price discrepancies. This can also include automated trading systems to actually detect and act on arbitrage opportunities.

How to Get Started with Crypto Arbitrage Trading

Select a number of cryptocurrency exchanges where the prices of the same assets differ. These need to be somewhat trusted exchanges, possibly with decent liquidity. Next, you need to open and set up accounts on those exchanges.

Deposit Some Funds into Your Accounts Put some funds into your exchange accounts. The step will ensure that when opportunities present themselves to buy cryptocurrencies, you’ll have enough capital to do so. Pay attention to deposit fees and processing times.

Track Price Differences

Utilize tools and software to monitor price discrepancies between exchanges. The real-time monitoring will help you to spot the profitable trades in very little time. You can set alerts for a large price difference.

Execute Trades

When you have found a price discrepancy, buy the cryptocurrency with a low price and sell it with a high price. It is very important to execute quickly because the price differences can disappear in a very short time.

Calculate Your Profits

After the trade execution is done, compute profits after transaction fees and other costs. Ensure that your profit outweighs the cost of going through the arbitrage process.

Crypto Arbitrage Trading Challenges

Price Fluctuations

Cryptocurrencies are so volatile. Prices change in a spur of a second and will affect your arbitrage opportunity. Always be up to date with market trends.

Transaction Fees

Trading, withdrawal, and deposit fees can quickly nibble into your profits. You should consider selecting exchanges whose fees are competitively enough and also factor in the amount in your calculation of profit.

Withdrawal Limits

Some exchanges have set withdrawal limits. The set limits may inhibit the quantity of cryptocurrency that you can transfer between the exchanges, therefore affecting your arbitrage strategy.

Regulatory Risks

There are different regulations concerning the trade in cryptocurrency in different countries. You need to make sure that you are in line with the set laws of your location to avoid legal problems.

Conclusion

Crypto arbitrage trading is one of the most promising forms of earning a profit through the difference between the prices that are traded on the cryptocurrency market. After being able to learn how to identify and take advantage of these price discrepancies, you would be able to facilitate an educated trading decision and maximize your returns. Keep yourself educated about changes and risk management; use tools that would enhance your arbitrage trading strategy Crypto Arbitrage Trading.