The overall market value of cryptocurrencies fell from $2.51 trillion in May 2024 to $1.95 trillion on August 6, 2024, indicating a decline in the sector. Over the past 24 hours, market volume has decreased by 13.13%. Why crypto market is down?, The biggest cryptocurrency, Bitcoin, is presently trading at $55,013, down 17.37% over the previous seven days and up 8.04% over the last twenty-four hours. The second-largest cryptocurrency, Ethereum, is currently trading at $2,447 after falling 26.53% over the previous seven days.

The value of cryptocurrencies sharply declined, losing around $367 billion in a single day between 7 August and 9 August. Major cryptocurrencies, such as Ethereum and Bitcoin, experienced significant declines as investors cashed out of high-risk holdings.

Let’s examine it in more detail why Crypto Market Is Down?

Why Crypto Market is Down?

On Monday, August 5, the Japanese stock market fell 12%, marking the worst day in 37 years. Due to the magnitude of the decline, global stock markets experienced losses. For instance, the Nasdaq index fell more than 6%, and the S&P 500 fell 4.25 percent in the United States.

Since then, markets have somewhat recovered. Tuesday saw a 1.5% increase on the Nasdaq and a 10.2% increase after business on the Nikkei 225 in Japan. But the next few weeks can still be difficult.

Fear of a downturn in the US economy is a major factor driving current gloomy markets. Data on the US labor market released on August 2 showed a weaker-than-expected job increase and the highest unemployment rate since October 2021.

As a result, investors are becoming more pessimistic about an imminent recession in the largest economy in the world.

The central banks of some major economies, including the European Central Bank and the Bank of England, have already lowered interest rates, have lower interest rates.

Additionally, the stocks of IT businesses in the US and elsewhere declined, contributing to the broader financial downturn. As a result, the crypto market is down, with the leading cryptocurrency, Bitcoin, seeing its price drop below US$50,000 (£39,000) just a week after reaching a record high of US$70,000.

During the same period, the prices of other cryptocurrency tokens, such as Solana and Dogecoin, also dropped by up to 30%.

The same concerns about a US recession that led to the stock market’s temporary collapse have been widely blamed for this cryptocurrency sell-off. However, this contagion effect is especially fascinating when seen from a financial standpoint.

The whole point of cryptocurrency was to defy centralized authority. Its goal was to provide a substitute for cash and investment that would not be impacted by the shortcomings of the established financial system.

As cryptocurrencies integrate more with the financial system, they are increasingly vulnerable to volatility from non-crypto markets.

Will the Markets for Cryptocurrencies Bounce?

Some investors who like risk find cryptocurrency assets intriguing due to their volatility. Notwithstanding the low prices right now, cryptocurrency investors are used to volatility and are considering if now is a good moment to purchase as they always are.

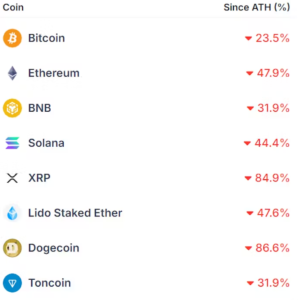

Technical analysis, which evaluates up-and-down-trending prices, has the drawback of frequently being extremely inaccurate in any market. Given that the crypto market is down and cryptocurrency values have only fallen below their all-time highs, there may still be an opportunity for further price declines.

Is Investing in Cryptocurrency Safe?

Over the last several years, the cryptocurrency market has experienced both positive and negative developments. Key events include the repercussions of the Russia-Ukraine crisis, the fall of Terra-Luna, the collapse of FTX, and tighter tax regulations.

The cryptocurrency industry made a complete turnaround in 2023 and began to show encouraging indications of resurgence. In times like these, cryptocurrency investors think it’s safe to invest in solid digital currencies like Bitcoin and Ethereum in SIP style.

Experts in cryptocurrency believe that investors should only contemplate allocating 5% of their total portfolio to cryptocurrencies. The most crucial thing to remember is that the market is extremely unpredictable, and you might lose everything. Therefore, you should only invest a small portion of your life savings.