According to SwissOne Capital, the Bitcoin (BTC) dominance rate and U.S. interest rates are positively correlated. However,Crypto the recent beginning of the Federal Reserve’s (Fed) rate-cutting cycle poses a risk to the ongoing increase in BTC’s dominance.

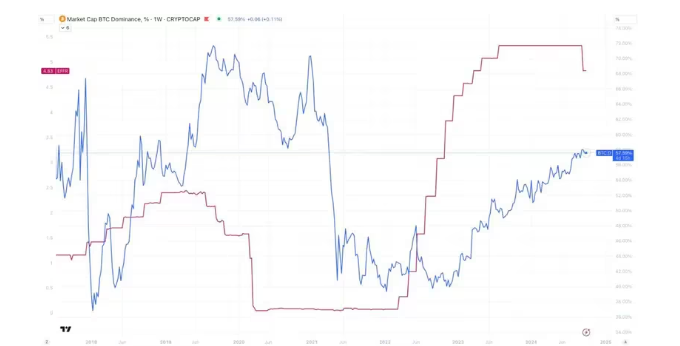

SwissOne Capital suggests that the Fed’s decision to lower rates may hinder the sustained upward trend in Bitcoin’s market share, which could affect broader gains in the cryptocurrency market. The BTC dominance rate, representing the cryptocurrency’s share of the total market capitalization, has risen from 38% to 58% over the past two years, as reported by TradingView. This indicates that BTC has outperformed the wider market, contributing to a doubling of the total digital asset market value, which now exceeds $2 trillion.

SwissOne Capital states that the potential for further increases in BTC’s dominance is limited, especially since the Fed recently cut rates by 50 basis points, marking the start of an easing cycle. The firm noted in a market update that “Bitcoin Dominance is positively correlated to the Fed Funds rate,” highlighting that BTC’s dominance typically declines during previous rate-cutting cycles.

Crypto

Historical data shows that Bitcoin’s dominance peaked above 70% and began to decline when the easing cycle commenced in the second half of 2019. By late 2021, the dominance rate had dropped to nearly 40% as central banks and governments injected trillions into the financial system to mitigate the pandemic’s effects, resulting in unprecedented risk-taking across financial markets, including alternative cryptocurrencies (altcoins).

Crypto

This positive correlation has also been observed during the rate hike cycles of 2018 and 2022-2023. SwissOne Capital remarked, “The recent start of the U.S. rate-cutting cycle certainly points to little further upside if history is to repeat itself.” According to the CME’s FedWatch tool, traders anticipate another 25 basis points rate reduction by the end of the year.

The BTC dominance rate has been producing lower peaks since 2015, indicating broader market growth. While the recent two-year surge is notable, it still leaves the metric significantly below its previous peak of 73%. This discrepancy may be attributed to the explosive growth of stablecoins, which have reached a record market capitalization of $172 billion.

SwissOne Capital suggested, “With stablecoin market caps close to 10% of total market cap, we believe it explains why Bitcoin dominance could be topping between current levels and 60% (maximum) before a major reversal occurs.”

A crypto asset manager has issued a warning regarding the potential decline of Bitcoin’s dominance in the market due to the Federal Reserve’s recent rate-cutting cycle. According to SwissOne Capital, there exists a positive correlation between Bitcoin’s dominance rate and U.S. interest rates, meaning that as the Fed lowers rates, Bitcoin’s share of the total cryptocurrency market capitalization could face downward pressure.

Over the past two years, Bitcoin’s dominance has surged from 38% to 58%, indicating a significant outperformance relative to other cryptocurrencies. This increase has contributed to a broader rise in the total market value of digital assets, which has now surpassed $2 trillion. However, the onset of the Fed’s easing cycle, which involved a recent cut of 50 basis points, raises concerns about the sustainability of this trend.

Historically, Bitcoin’s dominance tends to decline during previous rate-cutting cycles, as evidenced by its peak above 70% before the easing cycle began in the second half of 2019. As central banks globally injected trillions into the financial system to cushion the economic impacts of the COVID-19 pandemic, Bitcoin’s dominance fell to nearly 40% by late 2021. The influx of capital into alternative cryptocurrencies (altcoins) during this period also played a significant role in diluting Bitcoin’s market share.

SwissOne Capital notes that the current conditions may mirror past cycles, where the Fed’s shift to a rate-cutting stance often stifles Bitcoin’s upward trajectory. Traders, using tools like CME’s FedWatch, anticipate further rate reductions, which could exacerbate the downward trend in Bitcoin’s dominance.

Additionally, the rise of stablecoins, which now account for approximately 10% of the total cryptocurrency market capitalization, poses another challenge to Bitcoin’s dominance. The market capitalization of stablecoins has reached a record $172 billion, reflecting their growing popularity and utility within the Crypto ecosystem. This shift in investor preference could lead to Bitcoin’s dominance topping out between current levels and a maximum of 60% before a significant reversal occurs.

Conclusion

The interplay between the Federal Reserve’s monetary policy and Bitcoin’s market dynamics is critical for investors to understand. As the Fed embarks on its rate-cutting journey, the implications for Bitcoin’s dominance and the broader crypto currency market could be profound, warranting close monitoring in the coming months.