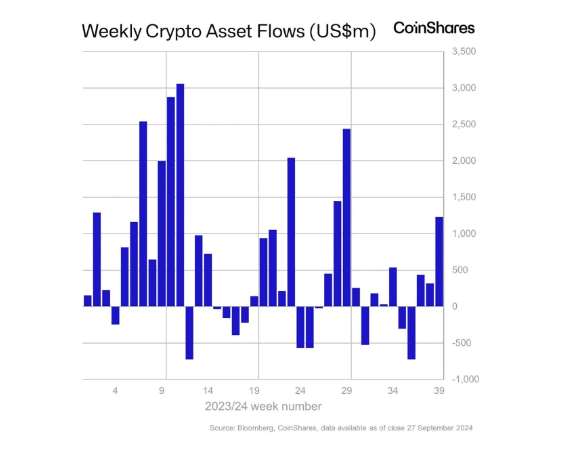

In a positive development for the digital asset market, crypto-related products have had one of their three consecutive weeks with inflows, amounting to a grand total of $1.2 billion. This has largely been due to the anticipation of dovish monetary policy in the United States, as stated in a recent report by CoinShares. The numbers regarding the uptick in digital assets, particularly Bitcoin and Ethereum, show renewed investor confidence and hope for better growth prospects in the market.

Impact of U.S. Monetary Policy

Market expectations regarding what the US Federal Reserve would do concerning monetary policy have been a huge enabler for trading activity in the digital asset market. Dovish monetary policy, which translates into the reduction of interest rates and other equivalent economic spurs, paved the way to higher investments in riskier assets, and cryptocurrencies did not remain an exception. Confidence in digital assets strengthened because investors believe that those policies will continue, allowing them to invest further.

According to research analyst at CoinShares, James Butterfill, “the inflow of capital that grew through the recent period must, in part, be attributed to the approval of options for certain U.S.-based digital investment products by the regulator. Offering more ample options for traders and institutional investors, this approval has contributed further to interest in digital assets.”

Market Sentiment and Overall Performance

The digital asset product AuM moved up and reached 6.2% last week, a measure of the increase in assets of a particular product. This increase indicates the rebuilding of confidence between investors and is generally on the rise in the market. However, trading volumes declined by 3.1% compared to the previous week. This gap between inflow growth and reduced trading may indicate that investors hold a more cautious optimism as they await stronger signals to commit large volumes of trades.

Regional Inflow Breakdown

There is quite a difference in sentiment regarding digital assets regionally. The United States and Switzerland have dominated the landscape of today’s market. The U.S. recorded inflows worth $1.2 billion, whereas Switzerland recorded inflows of $84 million, which is Switzerland’s biggest inflow since mid-2022. This growth in assets in the European market is good because it shows investor sentiment is improving more than just in the United States.

Outflows took place in Germany and Brazil for $21 million and $3 million, respectively. Regional differences are evident in the way investors view digital assets—they may be rather exuberant in some markets and much more guarded in others.

Bitcoin is, as usual, the primary beneficiary of this movement, accounting for 59.2% of all the inflows, followed by Ethereum at 20.5%. Bitcoin, the largest crypto by market capitalization, took most of the fresh flows during last week and, in turn, gained $1 billion, revived interest in short-bitcoin investment products, and had inflows worth $8.8 million overall. Overall sentiment towards Bitcoin remains positive due to continued optimism among investors about its future performance.

While other market participants are hedging their bets anticipating price corrections in the coming weeks, some are also there. This cautious approach reflects the inherent volatility that exists in the cryptocurrency market and finds investors seeking to balance portfolios under fluctuating prices.

Ethereum and Bitcoin Performance

The second largest cryptocurrency, Ethereum, finally ended five weeks of outflows, as inflows into the digital currency totaled $87 million. This resurgence of investor confidence is good for Ethereum since it marks its first real substantive inflows since early August. As the market continues to grow and evolve, renewed interest in Ethereum indicates that investors are becoming more optimistic about its future prospects and utility within the broader digital asset ecosystem.

One other major cryptocurrency, Solana, remains struggling and posted outflows of $4.8 million. Other altcoins have been the mixed bag, some showing inflows while the rest fail to attract and retain investor interest. For example, Litecoin and XRP reported inflows of $2 million and $0.8 million, respectively, indicating the fact that assets still remain attracted to some investors.

In contrast, Binance and Stacks had outflows of $1.2 million and $0.9 million, respectively. These outflows could be a reflection of the uncertainty and volatility still reigning in the altcoin market as investors take time to weigh their options and associate risks involving investing in them.

Conclusion

At such a time, when investor confidence was slowly regaining its lost steam, the digital asset market was experiencing an interesting trend. It was the third successive inflow at a cumulative figure of $1.2 billion, but the interest in cryptocurrencies and related products was clearly growing, on account of expectations that US monetary policy was going to become dovish once again and that new investment options for digital assets were through.

The evolution of the market will thus require vigilance from investors and self-awareness about the risks inherent in investments in digital assets. However, although this landscape does show much promise, the cryptocurrency market is highly volatile and indeterminant, and any cautious approach is thus warranted. In this regard, investors have to carry out proper research and consider their risk tolerance before reaching a decision on investments.