These countries excel in legal clarity, attractive tax rates, numerous registered crypto firms, and broad acceptance of cryptocurrency payments.

Dubai, Switzerland, and South Korea have emerged as leading destinations for cryptocurrency businesses in 2024.

According to a report from Social Capital Markets, these nations rank highly for their legal clarity and favorable capital gains and corporate tax rates. They also boast a substantial number of registered crypto firms and extensive acceptance of crypto payments.

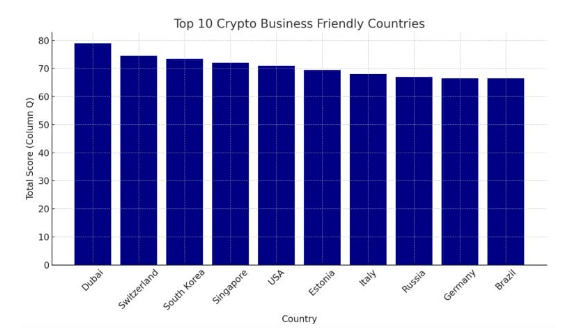

Each factor was scored out of 20, leading to a total of 100 points, which determined the rankings of the top 10 -friendly countries.

Dubai’s Forward-Thinking Crypto Policies Secure Its Top Ranking

Dubai achieved the highest score with 79, standing out for its regulatory clarity, lack of capital gains tax, a favorable 9% corporate tax rate, and low licensing fees.

By adopting a progressive regulatory framework and attractive tax policies, Dubai has positioned itself as a prime hub for cryptocurrency and blockchain initiatives. The establishment of the Virtual Asset Regulatory Authority (VARA) and the Dubai Financial Services Authority (DFSA) has created a clear legal environment that fosters innovation in the crypto sector.

Additionally, the DMCC Centre plays a crucial role in promoting the growth of crypto and blockchain enterprises by providing specialized infrastructure. With no capital gains tax on crypto transactions and a corporate tax threshold set at AED 375,000, Dubai’s tax strategy enhances its appeal to global crypto businesses.

Dubai

Switzerland’s ‘Crypto Valley’ Flourishes with 900 Companies and Investor-Friendly Tax Structure

Switzerland ranks second with a score of 74.5, featuring 900 registered crypto companies and offering no capital gains tax for long-term investors.

Switzerland’s financial regulator, FINMA, has developed a clear and supportive regulatory framework for crypto businesses, particularly in regions like Zug, known as “Crypto Valley.” Mandatory registration with FINMA provides legal certainty, enabling over 900 crypto firms to thrive in the country.

Switzerland’s tax system bolsters its attractiveness to crypto enterprises, with a capital gains tax of 7% and corporate tax rates ranging from 12% to 21%, which is more favorable than the global average. Additionally, more than 400 companies accept cryptocurrencies for transactions, showcasing the deep integration of crypto into Switzerland’s economy.

South Korea’s Evolving Crypto Framework and Tax Relief Propel It to Third Place

South Korea ranks third with a score of 73.5 and is actively influencing the global cryptocurrency landscape.

The Korea Financial Intelligence Unit (KFIU), under the Financial Services Commission (FSC), has established a developing regulatory framework designed to incorporate cryptocurrencies into the financial system. By mandating thatbusinesses register with the FSC, South Korea ensures regulatory oversight and legitimacy for these operations.

The country’s tax policies further enhance its appeal for crypto ventures. A delay in capital gains tax on currency, coupled with plans to introduce corporate tax in 2025, offers temporary tax relief that may attract more businesses.

With over 376 active crypto companies, South Korea is expanding its market and setting a regional example. State-backed initiatives, including exploration into Central Bank Digital Currency (CBDC), demonstrate the country’s commitment to blending regulatory clarity, business potential, and technological advancement, solidifying its influence in the global arena.