During a recent live broadcast on ETMarkets, which was organized in association with Delta Exchange, Saketh Ramakrishna gave a comprehensive explanation of the Iron Condor strategy.

This is an options trading method that is very helpful for controlling risk in the unstable cryptocurrency market. The demonstration of how traders may use this method to efficiently manage unpredictable market situations made the event an instructive opportunity.

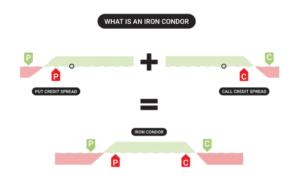

The Meaning of the Iron Condor

Using the non-directional Iron Condor strategy, traders may profit from low volatility by selling a put and a call option at one strike price while concurrently purchasing a put and a call option at a second strike price.

As a result, a range is established that the trader anticipates the price of the underlying asset will stay inside until expiration. The main advantage of the approach is that it may produce income while lowering risk, which makes it appropriate for situations where significant price swings are not expected.

How Does the Iron Condor Options Strategy Operate?

All that is required for an iron condor options strategy is the simultaneous and simultaneous sale of an OTM short call and a short put credit spread during the same expiry cycle. Because the bearish aspect of our short-call spread balances the bullish nature of our short-put spread, iron condors are a neutral strategy. Both profit from OTM expiration and hedge one another.

Iron condors function similarly to strangulations. A short strangle is a neutral strategy position that gains from any decreases in implied volatility when the stock remains between the short strikes over time.

- It entails the simultaneous sale of a bearish spread (short call spread) and a bullish spread (short put spread).

- When the position expires, the profit is realized when the stock lands between the strikes.

- As a spread trade position, the risk and return are known at the time of entry.

- The maximum possible profit is the credit gained for selling the position upfront.

- The maximum loss is equal to the width of the highest spread minus credit earned if spread widths differ.

We are betting against the underlying moving past or spread by the time our contracts expire because we want our options to expire worthless because we are getting a credit up front.

Real-World Utilization: An Example

During the session, an Iron Condor position was established for the August 30 expiry date. Over time, the position’s worth rose from Rs. 1 lakh to Rs. 1.08 lakh. This example gave participants a clear knowledge of how to set up and operate an Iron Condor in their reading and demonstrated how the technique might be used in actual trading circumstances.

Examining Different Approaches

The workshop covered a variety of techniques in addition to the Iron Condor, such a 60,000 short straddle with an expiration date of September 6. This method served as an example of the adaptation and flexibility needed for trading, especially in the quick-paced world of cryptocurrencies.

From these conversations, the participants gained a more comprehensive toolset for portfolio management, which also helped them understand when and how to use various methods based on market conditions.

Iron Condor Maximum Profit

When building the four-leg options bets, the net credit earned represents the maximum profit potential for an iron condor. When the underlying settles between the trade’s short strikes at expiry, when all options expire worthless, the maximum profit is obtained.

Iron condor traders are not required to hold the strategy until it expires; for example, they can close a trade by routing the opposite order or “buying back” the iron condor using the same strikes and expiration cycle if they see a 50% profit, where the spread is trading for 50% of the credit received upfront.

Conclusion

ETMarkets Workshop give traders important insights into the intricacies of options trading in the cryptocurrency market by emphasizing real-world applications and practical examples. Comprehending trading methods such as the Iron Condor may be an essential component of a trader’s toolkit, enabling them to confront the difficulties posed by market volatility with increased assurance.