Following a thorough investigation into WazirX’s attack on July 18, renowned worldwide auditor Grant Thornton has verified the security of Liminal’s infrastructure.

In response to the breach, which went against WazirX’s systems, Liminal hired outside auditors to evaluate any possible weaknesses in its platform and initiated an internal inquiry. The company reiterated that the breach did not affect its systems.

The audit and forensics firm Grant Thornton, according to Liminal, carried out a thorough investigation of the infrastructure’s front end, back end, and user interface (UI) and found no proof that the assault started there.

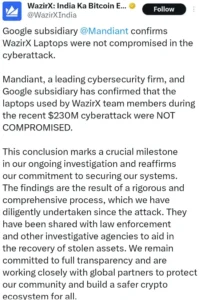

It claimed that every transaction starts at the client’s end. However, WazirX pointed the finger at liminal custody. WazirX engaged Google subsidiary Mandiant Solutions to conduct a forensic examination, which just gave the cryptocurrency exchange a clean sheet.

Liminal Cleared of the Blame Game

According to the Grant Thornton audit, which was a component of Liminal’s larger inquiry into the event, there was no indication of breach in Liminal’s frontend, backend, or user interface (UI).

The website, which provides self-custody wallet services in which users keep their private keys, was free of any breach-related risks. The third-party audit further guaranteed that Liminal’s systems would stay safe during the event, which resulted in losses exceeding $235 million.

Soon after the intrusion, Liminal initiated its internal investigation, looking closely at differences in data payloads between WazirX and Liminal’s system.

Liminal said that the assault that took place at WazirX could not have affected its self-custody wallet architecture, which is built to keep private keys and transaction initiations with the client.

According to Liminal, their research indicates that WazirX’s infrastructure is most likely where the incident happened. It further stated that differences between the data payloads from the two sides indicate that outside influences caused the breach. The exchange had already said that Liminal’s infrastructure could have been the source of the vulnerability.

Further actions

It also underlined its dedication to security and openness, stating that it will keep continuing its research and notify customers and users as new details come to light.

That said:

“Our focus on security and transparency is unwavering, and we are further strengthening our security measures in light of this incident.”

Even though Liminal’s systems passed the audit, the business announced that, as a precaution, it is further up its security procedures. It also pointed out that all client-initiated transactions in its self-custody wallets lower the possibility of internal security breaches.

Users Disapprove of WazirX’s Socialized Loss Strategy

Following the theft, WazirX suggested a “socialized loss strategy” that would let consumers access 55% of their money while keeping the remaining 45% in Tether (USDT) tokens, which the exchange holds.

Users, however, fiercely disagreed with this plan, accusing WazirX of abdicating all liability for the tragedy.

The outcry pushed WazirX to rethink its plan, and the exchange has subsequently pledged to investigate other ways to reimburse consumers who lost money in the hack.

In an effort to strengthen security after the assault, WazirX has also shifted its assets to new multi-signature wallets. Meanwhile, its exchange firm, Zettai, is pleading with white knights to help save WazirX.

Conclusion

According to an independent investigation by Grant Thornton, Liminal Custody’s infrastructure was not compromised in the $230 million WazirX hack. The study also confirms that the breach originated outside of their systems.

Although the precise cause of the breach is still unknown, Grant Thornton’s assessment suggests that WazirX’s infrastructure appears to have vulnerabilities compared to its Custody’s system.

It has greatly decreased the possibility that the breach came from its platform, thanks to its multi-signature wallets, which need client authorization, and its secure infrastructure.