Have you ever considered acquiring an NFT ? If you lack a strong desire to possess digital art, you can conclude they aren’t the right option.

However, did you realize that nearly everything can be digitally shown to be owned with NFTs? A non-fungible token uses a blockchain’s smart contract to facilitate a wide range of transactions.

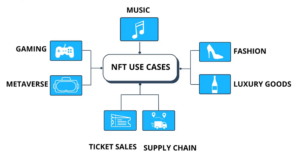

There is a lengthy and broad list of possible applications. These are eight current use cases for NFTs, at least in theory, as most have not yet seen significant acceptance.

-

Own digital collectibles

They best represent the ownership of digital artifacts like graphic art and game assets. By minting an NFT—that is, utilizing a blockchain platform to establish a unique token linked with the asset—the developer of a digital collectible can “tokenize” the item.

Platforms such as OpenSea and Rarible support marketplaces for tokenized digital collectibles. CryptoPunks and Bored Ape Yacht Club create the most well-known tokenized art, while CryptoKitties is a well-liked NFT-based game featuring virtual cats.

-

Collect fine art

Fine art may be traced back to its owner via a non-fungible token. They may be created and linked to any actual artwork to tokenize it. The smart contract that powers the NFT encodes details about the artwork, including its origin, author, and present owner.

You may partially own a single work of art by using NFTs to “fractionalize” the ownership of physical art, in case you didn’t know that. A costly work of art may be tokenized into several NFTs, each of which represents a portion of the asset’s ownership.

Investing in beautiful art on a tight budget may be feasible with tokenizing. The systems that tokenize great art into NFTs for fractional ownership include Masterworks, Maecenas, and ArtSquare.io.

-

Fractionally invest in real assets.

Non-fungible tokens allow investors to possess fractions of actual assets, much like they might facilitate fractional investments in fine art. With NFTs, real estate and wealthy possessions like yachts and private planes may be tokenized into ownership shares.

Many investors find fractional investment in real properties attractive since it offers the advantages usually associated with this asset class but at a fraction of the cost.

Investing in a diverse range of assets allows investors to diversify their real asset portfolios. Additionally, thanks to NFTs, fractional ownership interests may be bought and sold online.

A number of systems support fractional ownership of real assets. For fractional boat ownership, Salient Yachts mint NFTs, whereas RealT tokenizes residential real estate.

-

Buy a home

One possible use for a non-fungible token is establishing home ownership. When all necessary requirements are satisfied, the seller of a home may produce an NFT showing ownership of the property and transfer it to the buyer. Tokenizing the ownership of a property may make transparent, safe, and effective home-buying transactions possible.

One tool that facilitates decentralized title registries is Propy. The software tracks the whole life cycle of real estate and title records using blockchain technology.

-

Purchase a vehicle

Do you prefer to spend a lot of time on tedious tasks like auto registration? Should that be the case, you might be happy to learn that non-fungible tokens might be linked to certain automobiles in order to prove ownership.

Paper titles, farewell? In theory, yes, but not yet. Drivers cannot use NFTs as proof of automobile ownership until certain regulatory obstacles are removed. Even without formal titles, companies such as CarForCoin already provide NFTs to prove ownership of high-end cars.

-

Get insurance

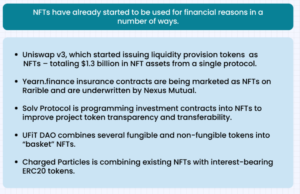

Blockchain technology can make the claims process more transparent and open doors for everyone in a blockchain network to offer insurance. Additionally, they can make it possible to buy, sell, and swap insurance products.

Anyone may currently construct an insurance product using platforms like Etherisc. Insurance based on blockchain is available for crop protection, hurricanes, and travel delays, among other things. However, insurance is another heavily regulated sector, so before traditional insurance firms can rely on them.

-

Get reward tokens

They allow businesses to provide their clients with exclusive benefits. In addition to transferring ownership of a rare digital object or enabling unique access or privileges, an NFT may also be used to customize a digital experience. NFTs created from rewards can also be sold or exchanged.

They are being tested by big businesses like Taco Bell to increase consumer loyalty. In 2019, Nike obtained a patent for “Cryptokicks,” which combines non-fungible currencies with actual shoe launches.

Conclusion

Tokens that aren’t tradable represent advances in technology. NFTs, which can assign value to even intangible things, might drastically alter the way that ownership and value are allocated.

However, regardless of whether the collectible is tokenized or not, if you don’t want to possess a digital collectible, don’t buy one. Recall that it is dangerous to use non-fungible tokens.