Tether’s USD-pegged stablecoin, USDT, has crossed the $120 billion market cap for the first time, indicating the possibility of a crypto market rally. According to live data from Tether’s official site, this milestone was reached on October 20, highlighting the rising demand for the world’s largest stablecoin. Stablecoin, like USDT, often serve as bridges between traditional fiat currencies and the digital asset market. A surge in stablecoin supply is typically interpreted as a bullish signal, suggesting that investors are accumulating stablecoin in preparation for investing in cryptocurrencies.

This increasing USDT supply may act as a catalyst for Bitcoin’s next price surge. Back in August, Tether minted $1.3 billion worth of USDT in just five days following Bitcoin’s dip to a five-month low at just above $49,500 on August 5. The influx of USDT helped Bitcoin rebound, climbing over 21% to $60,271 by August 9.

The question now is whether the current $120 billion in USDT could ignite another “Uptober” rally—a term used to describe October’s historically positive performance for Bitcoin prices. The growth in Tether’s supply, particularly flowing into centralized exchanges, suggests an increase in buying activity. Data from Arkham Intelligence shows that in the past 48 hours alone, Tether’s treasury sent more than $66 million in USDT to Binance and over $20 million to Kraken, hinting at potential incoming pressure from crypto investors looking to buy up assets.

Considering Tether’s key role in liquidity for the crypto market, it’s possible that this influx of stablecoins into major exchanges will precede another Bitcoin rally, with October shaping up to live up to its bullish reputation.

bitcoin price in India

On the flip side, a slowdown in stablecoin inflows often signals an impending correction in the crypto market. For instance, on August 12, Bitcoin’s price dipped below the critical $60,000 level, experiencing a nearly 4% correction as institutional buyers temporarily halted their purchases of USDT.

Now, the big question is :

Can stablecoin stage a breakout before the end of October?

Some analysts believe it’s possible. Based on historical chart patterns, there were predictions of a three-month rally for Bitcoin, targeting $92,000 after September’s bearish trend.

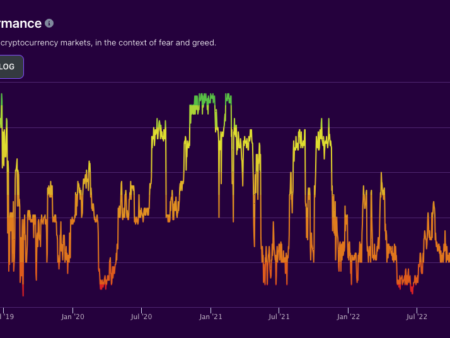

Historically, October has been Bitcoin’s second-strongest month in terms of price performance. On average, Bitcoin has posted a 21% return in October, making it one of the best-performing months for the asset, according to CoinGlass data. Only November has performed better, with an average return of over 46% for Bitcoin.

With growing market optimism, speculation is rising that Bitcoin could see a strong move before October wraps up. However, uncertainty remains—if the expected stablecoin inflows don’t materialize or if market sentiment shifts, it could also delay the anticipated breakout. Nonetheless, given the past trends, many traders and investors are watching closely to see if Bitcoin will once again take advantage of October’s historically bullish trend.

During the last Bitcoin halving year in 2020, the price surged by more than 27% in October and over 42% in November, kicking off a six-month rally that extended until March 2021.

For Bitcoin to confirm a potential breakout from its current sideways movement, often referred to as a “crab walk,” it would need to close the week above $68,700, according to well-known crypto analyst Rekt Capital.

Rising inflows into Bitcoin exchange-traded funds (ETFs) could play a key role in Bitcoin’s potential breakout. On October 17, Bitcoin ETFs surpassed a record $20 billion in total net inflows, just 10 months after their launch.

In comparison, it took gold-based ETFs nearly five years to reach the same $20 billion milestone. This rapid growth in Bitcoin ETF inflows highlights the increasing institutional interest and adoption of Bitcoin as a mainstream asset. The swift accumulation of Bitcoin ETFs suggests that many investors are eager to gain exposure to Bitcoin in a regulated environment, which could further fuel market demand and push prices higher.

As these inflows continue to rise, Bitcoin’s price may gain additional momentum, with some analysts suggesting that the ETF market could serve as a major catalyst for a sustained price rally. This growing institutional interest through ETFs marks a significant shift in the perception of Bitcoin as a speculative asset to one with long-term investment potential.