Bitcoin continues to be a hot topic in 2024. Investors, traders, and enthusiasts are all watching its price with keen interest. Bitc0in has experienced significant fluctuations over the past few years, making it a challenging but exciting market to follow. This article will delve into the key trends that could shape Bitc0in’s price in 2024. By understanding these trends, you can make informed decisions and stay ahead of the market.

1. Institutional Adoption is Accelerating

Institutional adoption of Bitcoin is growing rapidly. In 2024, more large-scale institutions are investing in Bitc0in. This trend started a few years ago but is now gaining momentum. Companies are adding Bitc0in to their balance sheets, and investment firms are offering Bitcoin-related products to their clients.

This institutional interest is driving Bitc0in’s price higher. When big players enter the market, they bring significant capital with them. This influx of money increases demand, pushing prices up. Therefore, keeping an eye on institutional adoption is crucial for accurate Bitc0in price analysis.

2. Regulation and Government Policies

Regulation plays a pivotal role in Bitc0in’s price movements. Governments worldwide are taking different approaches to regulating Bitc0in. In some countries, regulations are becoming stricter, which could limit Bitc0in’s growth. In others, favorable policies are encouraging more people to invest in Bitc0in.

In 2024, regulation remains a significant factor in Bitcoin price analysis. Any new laws or policies can impact the market immediately. For example, if a major economy imposes harsh regulations, Bitc0in’s price might drop. Conversely, positive news can cause a price surge. Watching the regulatory landscape is essential for anyone involved in Bitc0in trading.

3. Technological developments and upgrades

Bitcoin’s underlying technology is continuously evolving. In 2024, several technological developments could influence its price. One key area to watch is Bitc0in’s scalability solutions. As the number of transactions increases, the network needs to handle more data efficiently.

Developers are working on upgrades to improve Bitc0in’s transaction speed and lower fees. These advancements can make Bitc0in more attractive to users and investors, potentially driving up its price. Additionally, innovations like the Lightning Network are enhancing Bitcoin’s usability, making it more appealing for everyday transactions.

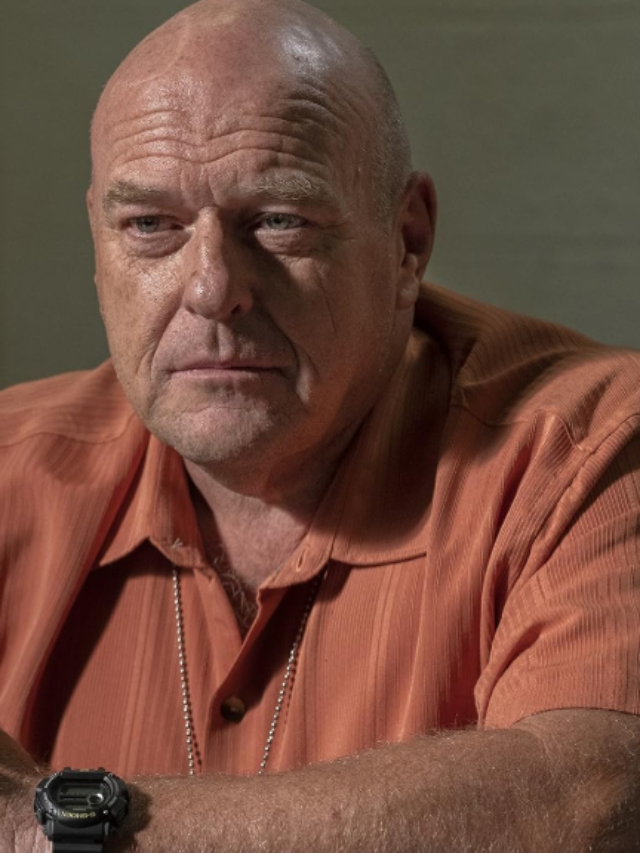

Bitcoin

4. Market Sentiment and Investor Behavior

Market sentiment significantly impacts Bitcoin’s price. In 2024, investor behavior continues to be influenced by a mix of fear and greed. News events, social media trends, and market speculation all play a role in shaping sentiment.

Positive news often leads to a price rally as investors rush to buy Bitc0in. On the other hand, negative news can trigger panic selling, causing prices to drop. Therefore, understanding market sentiment is a crucial part of Bitc0in price analysis. Monitoring how investors react to different events can help predict price movements.

5. Global Economic Factors

Global economic conditions also affect Bitc0in’s price. In 2024, factors like inflation, interest rates, and currency fluctuations are important to consider. As traditional markets face uncertainty, some investors turn to Bitc0in as a hedge against economic instability.

For instance, if inflation rates rise, Bitcoin may become more attractive as a store of value. Similarly, if major currencies weaken, Bitcoin could gain popularity as an alternative asset. Keeping an eye on global economic trends will help you understand how they might impact Bitcoin’s price.

Conclusion

Bitcoin’s price in 2024 is shaped by various factors, from institutional adoption and regulation to technological developments and global economics. By staying informed about these key trends, you can make better decisions in the cryptocurrency market.

Understanding Bitc0in price analysis requires continuous monitoring of these factors. The market can be unpredictable, but with the right knowledge, you can navigate it successfully. Keep an eye on institutional movements, regulatory changes, technological upgrades, market sentiment, and global economic trends. These will be the driving forces behind Bitcoin’s price in 2024.