Scroll Announces Token Distribution Details

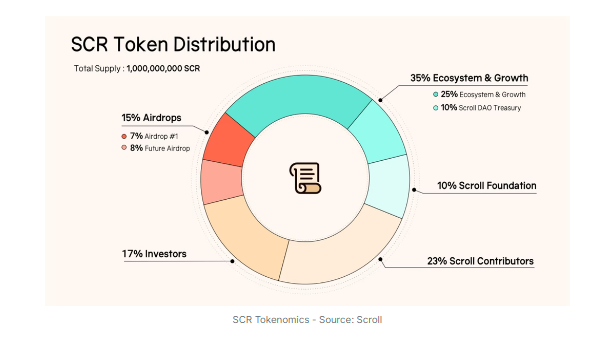

Scroll, the sixth-largest Ethereum Layer 2 by total value locked, has revealed its token distribution plans. The project has allocated 15% of its total supply of 1 billion SCR tokens to two airdrops, with 7% designated for the first airdrop and 8% for the second, scheduled to occur over the next 12 to 18 months. Investors will receive 17% of the tokens, while 25% will be allocated to ecosystem development and growth. Additionally, 10% will go to the Scroll DAO treasury, and the Scroll Foundation will receive another 10%. Contributors are set to receive 23% of the total supply.

SCR Anticipation

Scroll, a zkEVM rollup, currently holds the position of the sixth-largest Ethereum Layer 2, boasting a total value locked (TVL) of $1.18 billion, according to L2beat. The TVL of Scroll surged after the launch of its points program on April 18, increasing by 647% from $186.1 million to an all-time high of $1.39 billion by July 22. The Pencils Protocol farming dApp is Scroll’s largest DeFi project, with a TVL of $286 million, followed closely by Aave at $162.3 million, as reported by DeFi Llama.

Scroll has been anticipating airdrop excitement, with over 180,000 unique wallets interacting with Scroll’s alpha testnet within just one month of its launch on February 28, 2023.

Binance Announcement

The listing of the SCR token is among the most eagerly awaited events in decentralized finance. However, some traders expressed dissatisfaction that Binance disclosed its tokenomics five hours before the Scroll team did. Crypto analyst Ignas, co-founder of the DeFi creator studio Pink Brains, questioned whether Binance was front-running token generation event (TGE) announcements and voiced concerns about the token allocation details. Binance revealed that 5.5% of the total supply would be distributed to Binance whales for two days of farming.

A Binance spokesperson denied any accusations of front-running and noted that their pre-market trading allows users to take early positions before a token’s spot market listing. The platform introduced pre-market trading on September 25, enabling users to trade Launchpool tokens prior to their official spot market launch.

Launchpool Stakers

On October 8, Binance announced it would list SCR for Launchpool staking starting October 9. Users can stake either the FDUSD stablecoin or Binance’s BNB token for two days to earn a share of 55 million SCR, representing 5.5% of the total supply. Stakers from the BNB pool can earn up to 97,395 SCR per hour, while FDUSD pool participants can earn 17,187 SCR hourly. The BNB pool will account for 4.675% of SCR’s supply, with 0.825% designated for FDUSD stakers.

Binance plans to initiate “pre-market” trading for SCR on October 11, with 19% of SCR’s supply circulating at that time. Withdrawals, transfers, and deposits for SCR will be suspended during the pre-market trading phase, and Binance will exclusively manage SCR markets during this period. Users in 11 jurisdictions, including the United States, Canada, Japan, and Australia, are ineligible to participate in Launchpool staking.

Conclusion

The announcement by Scroll regarding the airdrop of 15% of its SCR tokens is a significant development for the Ethereum Layer 2 ecosystem. This initiative aims to engage its community and reward early supporters as the project continues to grow. With 7% of the total supply allocated for the first airdrop and 8% for the second, the timeline of 12 to 18 months for these distributions indicates Scroll commitment to fostering long-term community involvement. By including investors, ecosystem growth, and contributors in the token distribution, Scroll is positioning itself as a collaborative project that values stakeholder participation.

The anticipation surrounding the SCR token is also bolstered by Scroll’s impressive growth trajectory. The zkEVM rollup has garnered a total value locked (TVL) of $1.18 billion, making it the sixth-largest Ethereum Layer 2 solution. This growth can be attributed to innovative initiatives, such as its points program, which significantly boosted user engagement and capital inflow. As more users participate in the Scroll ecosystem, the demand for SCR tokens is expected to increase, further enhancing the project’s sustainability and potential for long-term success.

Moreover, the partnership with Binance for Launchpool staking amplifies the excitement around SCR’s launch. The ability for users to stake their FDUSD or BNB tokens to earn SCR rewards reflects a strategic move to attract a broader audience and ensure liquidity for the token. As trading for SCR begins, it will be interesting to see how the market responds to this new asset and whether it can sustain its upward momentum.

In summary, the airdrop of SCR tokens is more than just a distribution event; it is a strategic initiative aimed at building a vibrant community and ecosystem around Scroll. As the project evolves, its focus on community engagement and innovative DeFi solutions may position Scroll as a leading player in the Ethereum Layer 2 landscape, paving the way for future developments and opportunities.