Bitcoin Drops Amid Rising Geopolitical Tensions Following Israel’s Attack on Iran

Bitcoin experienced a significant drop following reports of Israel launching an attack on Iran. This latest round of geopolitical tensions has sparked widespread concern among investors, causing a sharp decline in cryptocurrency values. Notably, $BTC is dropping like a stone as the news unfolds, highlighting the market’s sensitivity to geopolitical events.

Crypto Market Response to Geopolitical Events

Following Israel’s attack on Iran earlier Saturday morning, Bitcoin and the broader crypto market took a hit. The BTC price dropped to its support level of $65,500, while altcoins suffered even greater pullbacks, with Ethereum (ETH), BNB, SOL, and XRP declining by 3-6% each. Risk-on assets like crypto are known to react quickly to geopolitical uncertainties. However, history has shown that such incidents often lead to quick rebounds; for instance, the last time a similar situation occurred, both Bitcoin and altcoins recovered rapidly.

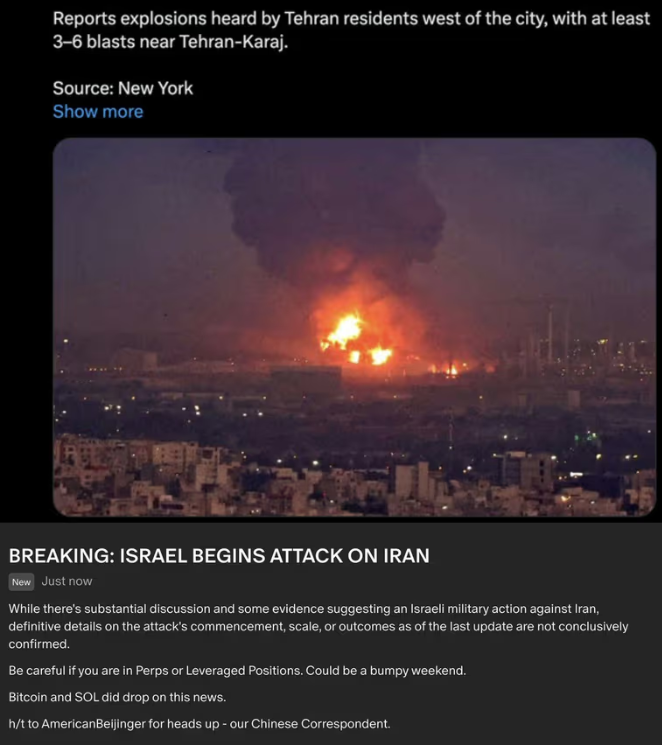

Details of the Attack

In the early hours of Saturday morning, Israel’s military conducted what they described as “precise strikes” on Iranian military bases, escalating tensions in the Middle East. Media reports indicated that strong explosions were heard in Tehran, prompting a market reaction that dragged Bitcoin and altcoins lower. Despite the current dip, market analysts believe this crash will likely be short-term. Earlier this year, during Israel’s first strike on Iran, BTC experienced a decline of more than 4% in one day but bounced back within just four hours.

Altcoin Impact and Market Analysis

The altcoin market felt a more significant impact, with Ethereum’s price falling another 3% to around $2,450, extending its weekly losses to over 7.68%. Solana (SOL) also saw a drop of 6.3%, slipping under $165. Interestingly, Solana had previously outperformed BTC and other altcoins, posting an 11% gain over the past month.

Moreover, analysts noted that the ALT/BTC trading pair reached a new low earlier today. Crypto analyst Benjamin Cowen indicated that altcoins might continue to fall in the upcoming months.

israel

Israeli Defense Forces Statement

The Israel Defense Forces (IDF) released a statement on X, addressing the military actions. They stated, “In response to months of continuous attacks from the regime in Iran against the State of Israel—right now the Israel Defense Forces is conducting precise strikes on military targets in Iran. The regime in Iran and its proxies in the region have been relentlessly attacking Israel since October 7th—on seven fronts—including direct attacks from Iranian soil. Like every other sovereign country in the world, the State of Israel has the right and the duty to respond. Our defensive and offensive capabilities are fully mobilized. We will do whatever necessary to defend the State of Israel and the people of Israel.”

Wall Street Journal’s FUD Attack on Tether

In a separate yet concerning development, the Wall Street Journal (WSJ) published an article alleging that Tether is under investigation for potentially violating sanctions and anti-money laundering regulations. The WSJ claims that sources indicate Manhattan’s U.S. Attorney’s office is exploring whether Tether has been used to fund or launder money associated with criminal activities like terrorism, drug trafficking, or hacking.

The report also stated that the Treasury Department is contemplating sanctions due to Tether’s use among groups sanctioned by the U.S., including organizations like Hamas and Russian arms dealers. If such sanctions are imposed, Americans could be generally restricted from engaging with Tether.

Market Reaction to Tether News

The news regarding Tether contributed to Bitcoin’s decline, pushing the price down to $66,200 before it partially recovered and then dropped again to $66,183 as the news of Israel’s military actions emerged.

Tether, which maintains a dollar-pegged value, is the most heavily traded cryptocurrency, with daily transactions reaching up to $190 billion. Its stability makes it particularly useful in regions where U.S. dollar usage is restricted. However, federal authorities have grown increasingly concerned about its connections to issues such as North Korea’s nuclear program and Mexican drug cartels. In response to these allegations, Tether stated, “To suggest that Tether is somehow involved in aiding criminal actors or sidestepping sanctions is outrageous,” asserting their cooperation with law enforcement to combat illegal activities.

Conclusion:

The cryptocurrency market remains highly reactive to geopolitical events, as demonstrated by the recent drops in Bitcoin and altcoins following Israel’s military actions in Iran. While short-term declines are common in response to such news, history suggests that markets can rebound quickly. Investors should remain cautious and stay informed about ongoing geopolitical developments and regulatory scrutiny surrounding major cryptocurrencies like Tether.