The crypto trading world has been continuously in the spotlight over the past decade, marked by its exponential growth in popularity and a surge of investors. Many enthusiasts refer to it as the place where fortunes can be made, thanks to its highly profitable opportunities. Recently, a crypto investor exemplified this notion, earning an astonishing $140K within just 20 minutes by executing a well-timed trading strategy. However, such remarkable achievements are far from simple; they typically require years of experience and a profound understanding of the crypto market.

The $140K Crypto Trading Story

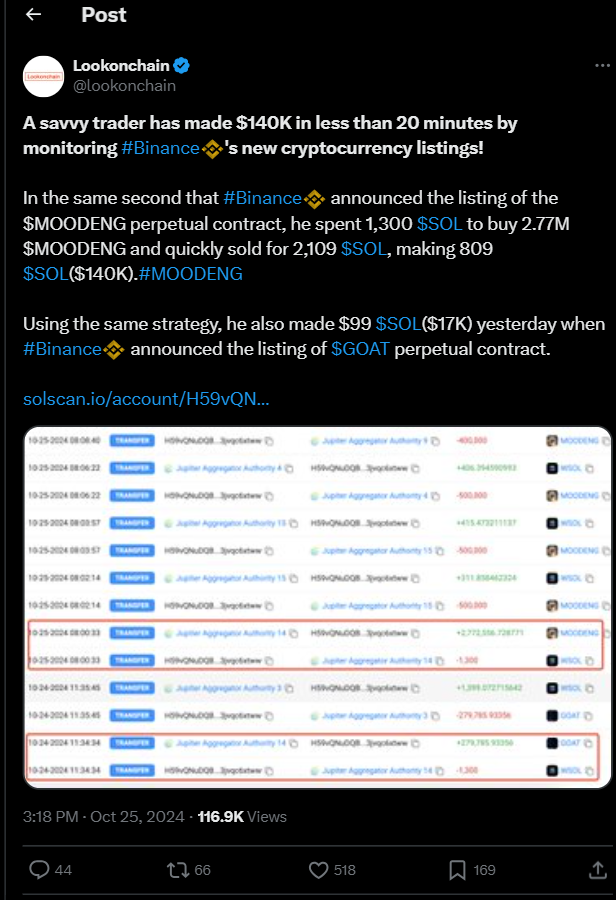

According to a recent post by Lookonchain on X, a savvy crypto trader devised an impressive strategy to amass hundreds of thousands of dollars in mere minutes. The adventure began when this investor closely monitored the Binance crypto listings, anticipating potential price pumps for newly listed tokens. Binance, being one of the largest centralized exchanges, can significantly influence a token’s price upon its listing.

As soon as Binance announced the listing of the $MOODENG perpetual contract, the investor jumped at the chance and acquired a substantial supply of MOODENG tokens. He spent 1,300 $SOL to purchase 2.77 million MOODENG tokens, and the value surged almost immediately after the listing was made public.

A savvy trader has made $140K in less than 20 minutes by monitoring #Binance‘s new cryptocurrency listings!

“In the same second that #Binance announced the listing of the $MOODENG perpetual contract, he spent 1,300 $SOL to buy 2.77M $MOODENG and quickly sold for 2,109 $SOL…”

— Lookonchain (@lookonchain) October 25, 2024

crypto

The token’s value skyrocketed following the Binance launch, turning his initial investment of $1,300 into a whopping 2,109 $SOL. This impressive move netted him a profit of 809 $SOL, equivalent to around $140K in fiat currency. Notably, using a similar trading strategy, he also managed to secure another $17K from the $GOAT perpetual contract listing on Binance, demonstrating that this was not merely a stroke of luck.

The Right Timing and Strategy

Getting into crypto trading requires not just the right opportunity but also the ability to manage profits and minimize losses, which this investor excelled at. He strategically invested at the optimal moment—before the Binance listing—and in trending meme coins like MOODENG and GOAT, both of which are currently making waves in the crypto community.

Understanding the Market Dynamics

For those unfamiliar with the crypto market, it’s essential to recognize the factors that can impact the success of trading strategies. Market sentiment, for instance, plays a significant role in price movements. Positive news, such as a listing on a major exchange like Binance, can create a wave of excitement, driving up demand and prices. Conversely, negative news or market downturns can quickly erode gains.

Additionally, the liquidity of the tokens being traded is crucial. A highly liquid market allows for easier buying and selling without significantly impacting the price, while a lack of liquidity can lead to slippage, where the expected price of a trade differs from the actual price executed.

Is This New Listing Strategy Right for You?

The new listing strategy, while seemingly straightforward, can be quite challenging. One small misstep could lead to significant losses. Although it appears simple, successfully executing this strategy demands active vigilance for new listings across multiple popular crypto exchanges. Traders must be adept at identifying the right opportunities quickly.

With hundreds of new cryptocurrencies entering the market daily, only a select few will attract the attention of savvy traders. Anyone interested in this strategy must be quick on their feet, from searching for potential tokens to staying updated on exchange listings, and determining when to enter or exit a trade.

However, even with all this meticulous planning, this strategy may not be suitable for every crypto investor. Time-sensitive strategies demand a considerable amount of effort and carry inherent risks. Market volatility can drastically alter a token’s price trajectory, and liquidity issues may complicate trades. Furthermore, technical challenges and trading delays due to high volumes of participants can derail even the most well-planned trades.

Risks and Considerations

While many have found success using listing strategies, it’s essential to acknowledge the potential risks involved. The crypto market is notoriously volatile, with prices swinging dramatically within short periods. Factors such as regulatory news, technological changes, or broader economic conditions can have immediate impacts on cryptocurrency values. For instance, an unexpected regulatory announcement can lead to swift sell-offs, eroding gains in an instant.

Another risk is the psychological pressure of trading. The rapid pace of transactions can lead to emotional decision-making, which is often detrimental to a trader’s success. Investors need to remain disciplined, sticking to their strategies without being swayed by fear or greed.

Final Thoughts

Despite the challenges, some traders have found success using this listing strategy, contributing to its growing popularity within the industry. For those willing to put in the work and navigate the complexities, the potential rewards can be significant. However, aspiring crypto investors should approach with caution, understanding that while the allure of quick profits is tempting, a comprehensive strategy and risk management plan are essential for long-term success in the volatile crypto landscape.

As the market continues to evolve, education and adaptation will be key. New traders should consider joining communities, engaging with experienced traders, and utilizing resources to enhance their understanding of the market dynamics. By doing so, they can develop a more robust trading strategy that balances the thrill of potential profits with the necessity of prudent risk management. The journey into crypto trading can be rewarding, but it requires diligence, patience, and a willingness to learn from both successes and failures.