XRP Price Prediction: Whether you like it or not, XRP has established itself as a major participant in the cryptocurrency space. With a market capitalization position of eighth, XRP has been one of the top cryptocurrencies for over a decade.

Ripple Labs developed XRP to revolutionize global money transfers, aiming to offer a practical and affordable replacement for the current SWIFT financial system.

By using XRP, Ripple hopes to make money transfers as simple as sending an email by enabling quicker, less expensive international transactions.

Since cryptocurrency was developed to eliminate financial intermediaries like banks, XRP has generated controversy over time. The project has a cult-like following, with supporters eager to shut out critics and stand by their faith in XRP, even if some of them have made exaggerated claims about how quickly it may expand. Let’s understand XRP Price prediction.

XRP’s Price History

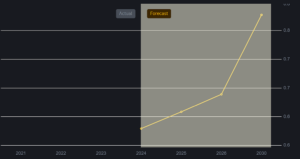

XRP’s price prediction journey has experienced incredible highs, sharp dips, and extended periods of steady decline.

The project introduced its token in 2013, but until the 2017 bull run, there was not much notable price movement. Listings on well-known exchanges, however, started to play a crucial role in the coin’s significant price increases following this time.

The introduction of Ripple’s xRapid product marked a turning point in history as it brought in the XRP cryptocurrency, which promised to transform money transfers overall and inside the banking sector in particular. The market gave an incredible response.

Despite the company’s recent winning streak, Ripple’s protracted legal dispute with the US Securities and Exchange Commission (SEC) has affected XRP’s price for the past few years.

Although it was just a partial triumph, the first came about because a judge decided in the previous year that Ripple had not broken any securities laws when it sold XRP to exchanges catering to ordinary investors.

For future XRP price prediction, it’s important to consider how ongoing legal battles and regulatory outcomes may continue to impact market sentiment and price movements.

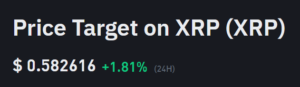

The second victory occurred when a court denied the SEC’s request to appeal the decision, which once more resulted in XRP’s price rising. The SEC’s lawsuit against the company’s CEO and executive chairman was dropped in October of last year, marking the third victory. On August 2, 2024, XRP’s market capitalization is $US32.30 billion, and its current price is $US0.57771.

Although the past cannot always foretell the future, Drozdz emphasizes that it can provide insightful information that can assist direct investment decisions.

How Will XRP Perform?

Following Ripple’s recent victorious run against the SEC last year, many investors are concerned about the future. The court decided that while the institutional selling of Ripple’s XRP tokens violated federal securities laws, the tokens sold on exchanges and through algorithms did not constitute investment contracts, marking a significant victory—albeit one only partially achieved.

In March, the SEC sought remedies against Ripple for the institutional sale of XRP, seeking almost $US2 billion. In response, Ripple stated that a fine over $10 million was not warranted in this particular case. This response was sent in late April. Since then, the SEC has responded, and the court will make the ultimate decision.

It is essential to comprehend the relationship between market performance and legal remedies. If the SEC case is resolved in a way that is advantageous to investors, investor interest in XRP may increase. Monitoring these developments closely will be key for future XRP price predictions.

However, they do not guarantee XRP’s price prediction in 2024 or beyond. Instead, they present a possible course. The outcome of the SEC case and the performance of the cryptocurrency market in the coming months will play a crucial role.

Conclusion

With the market reaching 12-month highs, investors are concerned about XRP’s nearly 15% drop since the beginning of January. Investors have shifted their money to other ventures due to apprehensions regarding the project and better prospects in the market, leading to the decrease.

Ethereum will soon have its own exchange-traded funds (ETFs) authorized later this year. The recent approval of bitcoin ETFs in the US has sparked interest in other cryptocurrencies.

Although XRP likely won’t attract an ETF anytime soon, anticipated decisions on Ether’s ETFs have surged its price. This discrepancy in market expectations has contributed to the current decline in XRP’s price.